Do you want to form an LLC in Florida or do you need a proper Florida LLC Operating Agreement sample with a template that you can easily use to outline how your LLC is operated and managed?

Then this post is for you!

As a business lawyer (and entrepreneur) practicing law in Florida, I have compiled this helpful blog post that includes many legal tips and resources you should be aware of.

So let’s get started!

Table of Contents

What’s an LLC in Florida?

First, let’s briefly talk about what’s an LLC in Florida.

An LLC in Florida is a Limited Liability Company, which is a legal business entity that combines the limited liability benefits of a corporation with the flexibility and pass-through taxation of a partnership.

The owners are referred to as members, and there can be one or more members in an LLC.

In Florida, forming an LLC requires filing paperwork with the Florida Division of Corporations. This paperwork outlines the purpose and structure of the business, as well as the name and address of the LLC, its members, and designated managers.

What is an LLC Operating Agreement in Florida?

An LLC Operating Agreement in Florida is a legal document that outlines the rules and regulations governing the internal operations and management of an LLC (Limited Liability Company).

It describes how profits, losses, and other business decisions will be managed by the members or managers of the LLC.

It also outlines voting rights, distribution rights, ownership interests, management duties, dispute resolution procedures, and other important details related to the business, which we will discuss more in detail below.

Having an Operating Agreement in place ensures that all members or managers are clear on their rights, obligations, and responsibilities as part of the LLC.

It also serves as a binding contract between you and the LLC, providing legal protection should any disputes arise.

An Operating Agreement is not required by law but it is strongly recommended for LLCs in all states, including Florida, to ensure that the business is properly organized and managed.

Member LLC v. Manager LLC Operating Agreement (Difference in Florida)

In Florida, a Member LLC and a Manager LLC are two different types of business entities that may be created.

A Member LLC is a limited liability company that has two or more members who share ownership in the company. The members will make decisions about how the company is operated, and all profits and losses will flow through to the individual members.

A Manager LLC has one or more managers who make all decisions about the company, and all profits and losses are allocated to these individuals.

The main difference between a Member LLC and a Manager LLC is in how control of the business is structured.

In a Member LLC, all members have equal authority to make decisions and vote on matters regarding the company. This can create a sense of equality and fairness among the members, while also allowing them to have more control over their own share of the business.

In a Manager LLC, however, one or more managers are designated to make decisions on behalf of the company. These managers may be appointed by other individuals that hold interests in the business, such as members or investors.

This structure allows for greater control over the business, but it can also create a power imbalance if the managers are not held accountable to all of the individuals involved in the company.

When creating an LLC in Florida, it is important to decide which type of entity would be most appropriate for your individual situation.

Single-Member LLC Operating Agreement in Florida

Let’s say you are the only owner of the LLC then you would be considered a single-member LLC.

A Single-Member LLC Operating Agreement in Florida is a legal document that spells out the rights and duties of a single-member LLC.

It sets forth the procedures for running your business, including how profits are divided, your management structure, tax responsibilities, and other important decisions related to the company.

It helps protect you against liability issues, and it also helps ensure that you are in compliance with state laws.

A Single-Member LLC Operating Agreement can help protect your personal assets (such as your home, car, and personal bank accounts) from being used to pay company debts.

Having an Operating Agreement in place is essential for single-member LLCs that are taxed as sole proprietorship or a disregarded entity under Internal Revenue Service guidelines.

It can help ensure that you get the most benefits possible from running your business while avoiding potential legal complications.

Multi-Member LLC Operating Agreement in Florida

Let’s say you have multiple owners of the LLC; they could be considered members of your LLC. You would designate the ownership percentage of each member in your Multi-Member LLC Operating Agreement.

A Multi-Member LLC Operating Agreement is a legal document used in the state of Florida to define the ownership and operating procedures for multi-member limited liability companies (LLCs).

This document outlines how profits and losses will be distributed, how decisions are made, as well as other important matters that may arise.

It also defines each member’s rights and responsibilities, as well as their respective voting power.

A Multi-Member LLC Operating Agreement is necessary to protect the interests of all parties involved in the LLC and ensure that everyone has a clear understanding of their roles and obligations.

An agreement also provides valuable protection for the members from potential liabilities. Also, if any disputes arise among the members, the agreement will help to resolve them in a fair and equitable manner.

By ensuring that all members have agreed upon certain terms and conditions, this document serves as an important tool for avoiding costly litigation.

A Multi-Member LLC Operating Agreement should be updated periodically to reflect changes in ownership, address new business opportunities, or make any other necessary revisions.

By taking the time to create this document, you can protect the interests of all involved and ensure that your LLC runs smoothly for years to come!

Benefits of a Member LLC Operating Agreement

-

Clearly defines how your LLC will be operated

The primary benefit of a Member LLC Operating Agreement is that it provides a clear framework for how the LLC will be operated and governed.

It outlines the roles, responsibilities, and rights of each member within the LLC, as well as any rules or regulations related to decision-making. This helps to ensure that everyone involved in running and managing the business has a clear understanding of their roles and obligations.

-

Clear Dispute resolution

A Member LLC Operating Agreement also helps to protect the interests of all members by providing guidance on how disputes should be resolved, what happens if a member wishes to leave or transfer ownership, and other important topics related to operating the business.

It can also serve as a reference document that can be referred to in the future when making decisions or resolving disputes related to the LLC.

Additionally, this agreement can provide important tax benefits for the LLC by setting out how profits and losses will be shared amongst members, as well as how the LLC is taxed.

This ensures that everyone has a clear understanding of their roles and responsibilities, as well as the goals of the business. By creating this agreement at the start, members can help to minimize potential conflicts and disagreements in the future.

Benefits of a Manager LLC Operating Agreement

Sometimes it will make sense to be a Manager-managed LLC when you have multiple members.

You might choose to designate one member to be the manager of the LLC to streamline business practices OR you could select a non-member of the LLC to be a manager.

-

Standardized Business Practices

Having a Manager-managed LLC can create standard operating procedures that set out how decisions are made, how meetings are held and other important business practices.

This makes it easier for members to understand how the company is run and can facilitate a smoother running of day-to-day operations. Additionally, it can help ensure that all parties involved in the LLC are aware of their rights and obligations.

- Increased efficiency and industry knowledge

Having a Manager-managed LLC can also result in increased efficiency if you choose a manager that has more industry knowledge and specialty than the other members.

This can help the LLC run more smoothly and make decision-making easier.

How to Define a Manager’s Authority in the LLC Operating Agreement

The LLC operating agreement is a key document that outlines the rules and procedures for running the business.

So it should include provisions regarding the authority of manager(s), such as who has the authority to make decisions, sign contracts, and access funds.

When defining the manager’s authority in an LLC operating agreement, there are several factors to consider and below are some questions to help you define a manager’s authority:

Are there any restrictions on the manager’s authority?

For example, do they need prior approval from other members before making decisions or signing contracts?

Who can remove a manager from their position and under what circumstances?

Are there any financial limitations on the amount of money that a manager is authorized to spend?

How is the manager’s authority defined in relation to other members of the LLC?

Are there any special privileges that the manager is granted?

These factors should be discussed and agreed upon by all members involved before being included in the LLC operating agreement.

Is an Operating Agreement Required for an LLC in Florida?

In Florida, an Operating Agreement is not required for an LLC. However, having a written agreement that outlines the roles and responsibilities of each member of the LLC can help to ensure that the business runs smoothly.

An Operating Agreement can also be helpful in resolving conflicts or disputes between members and provides legal protection if someone wants to sue the LLC.

Additionally, some banks may require an Operating Agreement as part of the process for setting up a business account or obtaining a loan.

Why Should I Have A Florida LLC Operating Agreement? (5 Reasons)

Here are 4 big reasons why you should have a Florida LLC Operating Agreement in place:

1. Establish the Rules of Your Business (LLC)

Keep in mind that without an Operating Agreement in place, you would have to rely on states default rules – Florida Revised Limited Liability Company Act (Florida statute), which sets forth rules on how your LLC must be operated.

If you want to be able to establish your own LLC rules such as designating manager authority, ownership percentages, and voting rights, you would need an Operating Agreement in order to that.

2. Clarify Member Relationships and Avoid Conflicts

An LLC Operating Agreement will help clarify the relationships between members, including their respective rights and obligations.

This agreement can specify how a member’s interest in the LLC will be valued, if and when a member may leave the LLC, and how profits or losses are distributed among the members to avoid any disagreements down the road.

3. Secure Lender Financing

Should your LLC need to secure financing from a lender, having an Operating Agreement in place can help you to demonstrate that your business is well organized and has clearly established rules for all participants.

This gives lenders greater confidence in your ability to effectively manage the loan and increases the likelihood of approval.

4. Provide Credibility

Having a written Florida LLC Operating Agreement provides credibility to your business and may help you secure investors or financing.

Potential partners will be more inclined to do business with you if they are confident that all the rules of the LLC are established in writing.

5. Protect Your Personal Assets and Limit Legal Liability

Ultimately, think of an LLC Operating agreement as your security blanket. It will help protect the LLC, its members, and its assets.

Although an Operating Agreement is not required to form an LLC in Florida, it can provide peace of mind and assurance that your interests are protected.

In addition, if you find yourself in court over a legal dispute, your LLC operating agreement will serve as proof that your personal assets are indeed separate from your business.

Florida Law on LLC and Operating Agreement

In case you are wondering, there are Florida state laws on LLCs and Operating agreements, which are included in Chapter 605 Florida Revised Limited Liability Company Act.

The state laws also outline what you can or cannot specify in your Operating Agreement; for example, you cannot change the Registered agent state requirement or relieve or exonerate a member from liability for acting in bad faith.

As per the Florida state rules, your LLC Operating Agreement serves as a legally binding contract that can later be used to enforce your legal rights in court. This includes a single member LLC Operating Agreement in Florida.

That’s why it’s important to make sure you are using an LLC Operating Agreement template (written by a lawyer) that accurately follows Florida state regulations and is actually enforceable in court.

What to Include in a Florida LLC Operating Agreement?

As mentioned above, your Florida LLC Operating Agreement is an important written contract on which you do not want to make legal mistakes.

Below are some of the important things you should include in a Florida LLC Operating Agreement:

1. Company name and purpose

You would include the name of the LLC, business of the company including its purpose, principal office address, the jurisdiction in which it was organized, and the address of its registered office.

2. Members and Membership interest

The names and addresses of all members should be listed in the LLC Operating agreement. This includes both managing members (also known as managers) and any non-managing members who have a financial interest in the business.

You may decide to add additional members as LLC owners.

You should also include how you will add or remove new members from the LLC. Make sure to list current members and their ownership structure.

3. Management Structure

The management structure of the LLC should be listed in the Florida operating agreement. This includes who will manage the business and how decisions will be made.

It should also address any restrictions on how members can transfer their interest in the company.

4. Registered agent’s name and information

You would include information about the registered agent, its name and office address.

5. Capital contributions and ownership interests

The LLC Operating agreement should list how much money each member has contributed to the business, and how much each member is entitled to receive from the business.

6. Distributions & Profits

The FL Operating agreement should specify how profits will be distributed among members, and what happens in the event of a loss.

7. Assignment or transfer of Member interests

The Agreement should also address the assignment or transfer of member interests in the LLC. This ensures that all members are made aware of any changes in ownership and agrees to them. It should also specify which members must approve any such transfers.

8. Dissolution

The agreement should specify how the LLC will be dissolved and all assets distributed. This is important to ensure that members are clear on what will happen in the event that the business terminates its operations.

9. Articles of Amendment

The agreement should also provide for any amendments or modifications to the agreement in the future. This ensures that all members are aware of and agree to any changes in the LLC structure or operations.

10. Limited Liability of the Members

You should also include in the Operating Agreement limitation of liability of members and the fact that they will not be personally liable for the LLC debts and liabilities.

It’s also important to include any asset protection provisions of your membership structure.

11. Termination of the LLC

You should also include provisions for the termination of the LLC. This includes how and when it will be terminated, as well as any restrictions on how members may terminate their interest in the business.

12. Governing Law and Dispute resolution procedures

You should include the governing law for the LLC, as well as any dispute resolution procedures. This helps ensure that all members follow the same rules and regulations when dealing with legal issues or future conflicts.

and more!

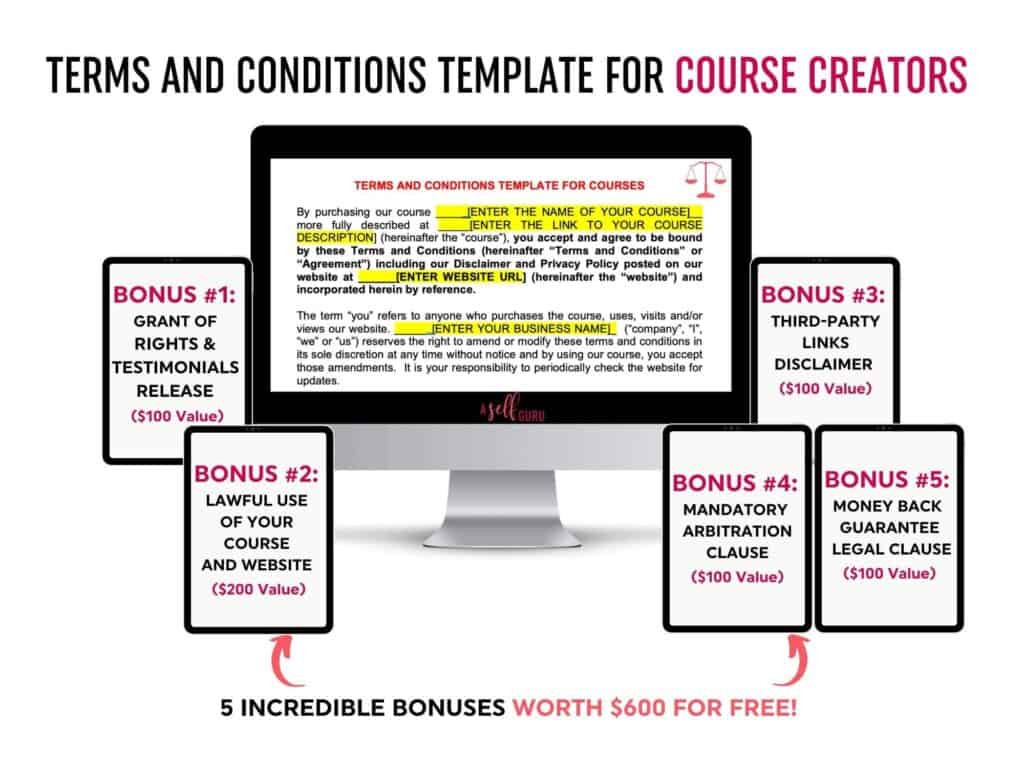

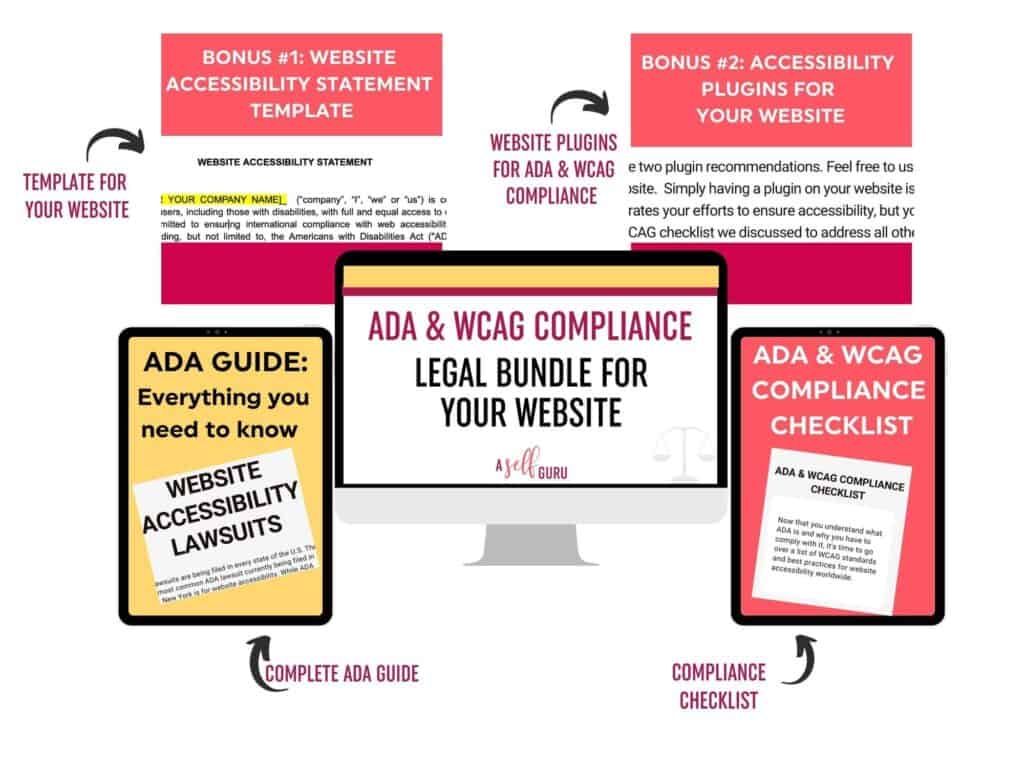

Florida LLC Operating Agreement Sample & Template (MS Word):

Putting together a Florida LLC Operating Agreement is not easy; it requires a lot of attention to detail and understanding of the governing laws.

That’s why as a business lawyer practicing for over 13 years, I have put together the Florida LLC Operating Agreement template that you can easily use to get done with your Operating Agreement in just 15 minutes!

This template is super easy to use, and includes all the important legal provisions you should include in your Operating Agreement.

It’s a comprehensive legal template that comes in an easily editable word document.

It includes everything we have covered above and more! You just plug in your business details and begin using it in 15 minutes or less.

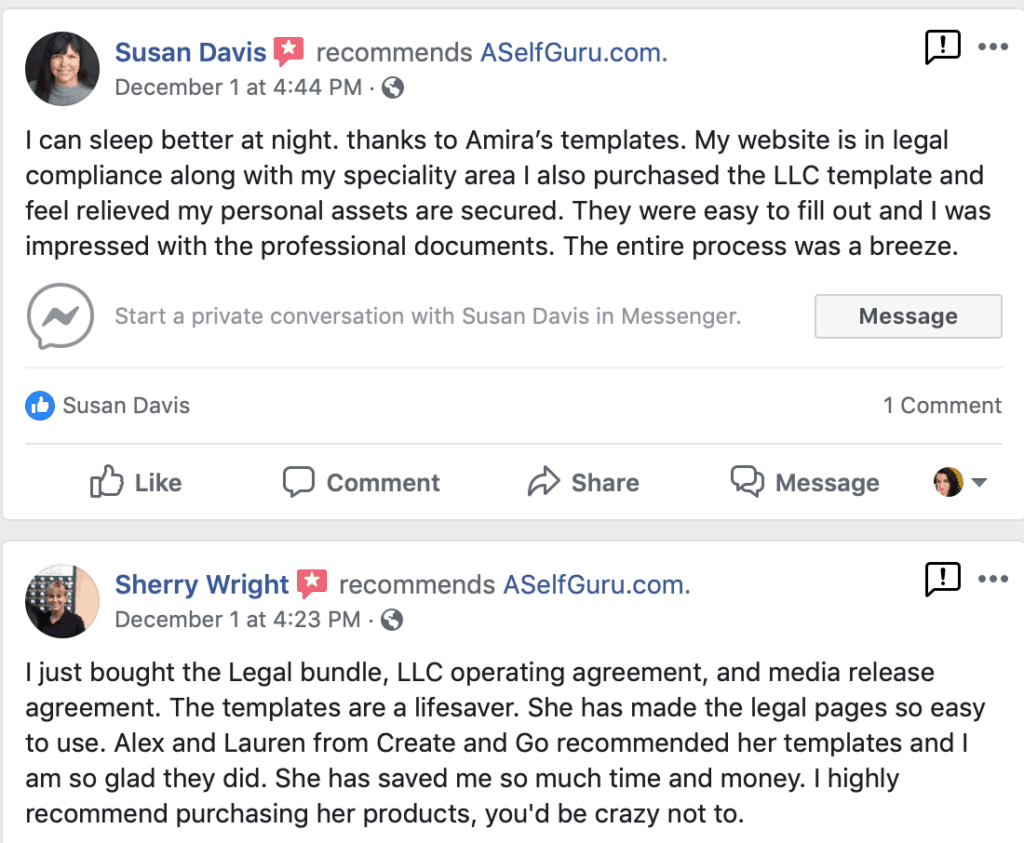

See how my customers, Susan and Sherry, use this LLC Operating Agreement to sleep peacefully at night knowing their personal assets are secured.

Florida LLC Operating Agreement Template (Sample)

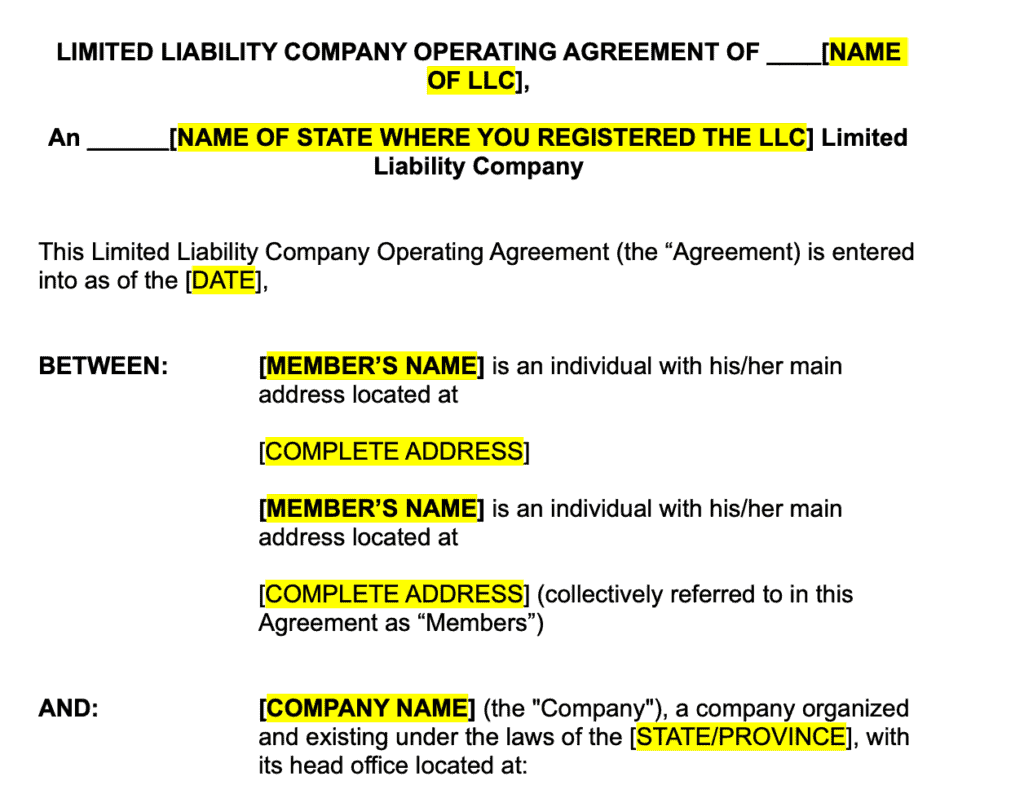

As you can see, you simply fill in the highlighted blanks of this template as instructed.

This Operating Agreement can be used for Florida and any other state in the US and comes with:

- A comprehensive legal agreement (Microsoft word that’s an instant digital download)

- Includes all the legalese you need to protect yourself and your LLC

- A comprehensive legal template that’s going to limit your legal liability

- Drafted by an experienced lawyer who has more than 13 years of legal experience.

- It comes with easy idiot-proof instructions to customize the template based on your business in 15 minutes or less!

- Instant download so you can begin using the legal template right away!

- Lifetime access to free updates.

- Free access to our private Facebook support group here.

- Trusted by over 30,000+ bloggers, course creators, freelancers, and entrepreneurs. You can use this Operating Agreement template for multiple LLC’s.

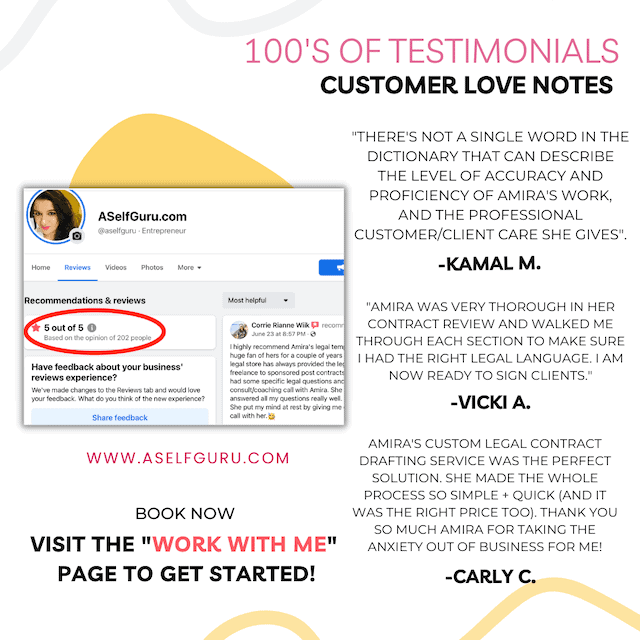

Here are tons of love notes from business owners using my legal templates including this one.

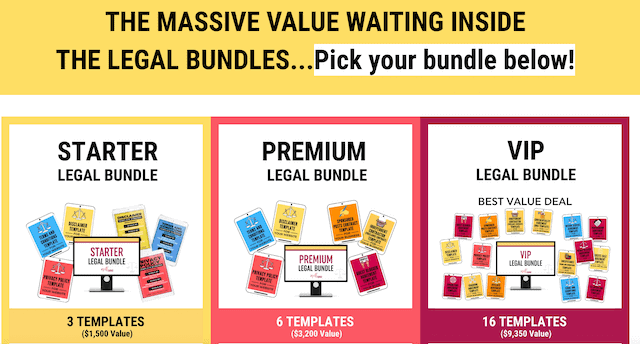

If you’d like to save MORE money and time, then grab my VIP legal bundle here, which includes this LLC Operating Agreement and 15 additional legal templates you’ll need to protect your business (plus you’ll get $2000+ in 16 incredible bonuses not found anywhere else!).

This is a great way to save $1000+ off on this legal bundle.

Updating and Amending Your Florida LLC Operating Agreement

You should review and update your Florida LLC’s operating agreement periodically.

This will ensure that the document accurately reflects the current operations of your business.

Even if you haven’t made any substantial changes to your LLC, it’s still important to review and amend the operating agreement at least once a year.

If you need to make changes to your operating agreement, you can do so either by unanimous consent of all LLC members or in accordance with the terms set forth in the document.

If a majority of members agree to the changes, they will become effective upon execution of an amendment.

Every LLC Member Should Keep a Copy of the LLC Operating Agreement

Every member of your LLC should have a copy of the operating agreement, as well as any amendments that have been made. This will ensure that all members are aware of their rights and responsibilities under the agreement.

Additionally, it can be used to resolve any disputes or disagreements among members in accordance with the terms set forth in the document.

Legal Help with a Florida Limited Liability Company Operating Agreement (Tips from a Lawyer)

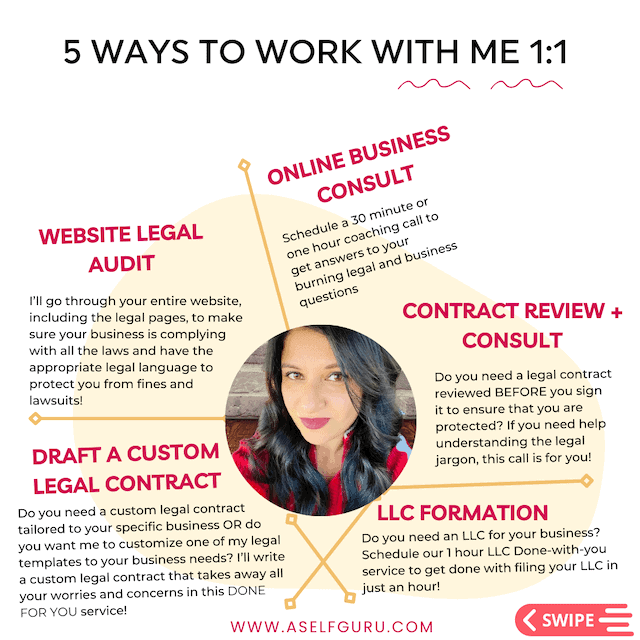

If you have any legal questions about your FL LLC or LLC’s in general, you can always schedule a consult with me here. I get tons of business and legal questions all the time, and some of them are answered in this blog post.

You can also check out this legal tips page to get more legal help but scheduling a call with me is the best way to get personalized help that’s specific to your business.

How Much Does it Cost to Form an LLC in Florida?

At the time of writing this blog post, the cost to form an LLC in Florida is $125. After that, you have to file an annual report and pay an annual fee to keep your LLC active in Florida.

How to Form an LLC in Florida

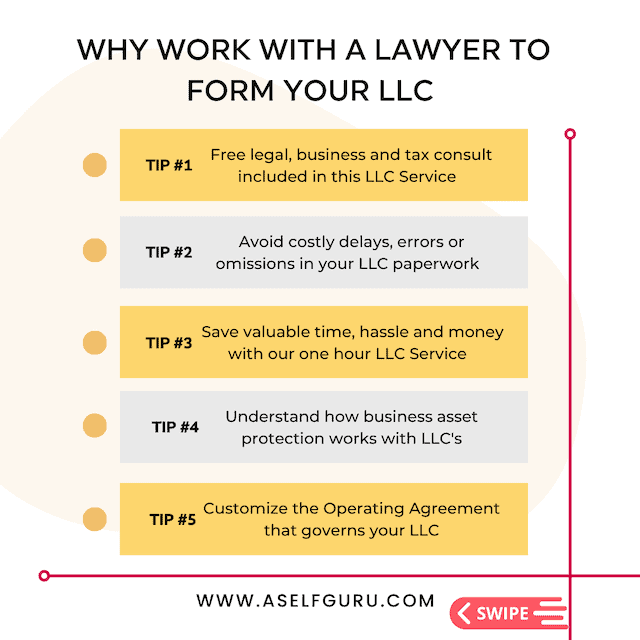

If you are looking to form an LLC in Florida, you can work with a lawyer like me to make sure you complete and file the necessary paperwork correctly.

I am a Florida licensed lawyer who has formed multiple LLC’s for myself and other business owners, so I am very familiar with the entire process.

Below are the important steps you’ll need to follow:

Step 1 –Conduct LLC Name Search

Conduct a name search statewide to make sure you are not infringing upon someone else’s business name. This is not the same as a federal trademark search, which is also recommended if you think about filing a trademark in the future.

Step 2- File Articles of Organization

Make sure to correctly complete the Articles of Organization for your LLC and then file it with the secretary of state.

Step 3 – Select a Registered Agent

You can use a registered agent service like this one or become the LLC’s registered agent yourself. This information is part of the public records.

Just keep in mind that your registered agent will require a physical address in the state of Florida. PO Box addresses are not permitted.

Step 4 – Decide Whether Manager or Member LLC

As part of your LLC formation documents, you will have to decide whether your LLC will be a member or manager managed and then list all those members or managers in your Articles of Organization.

Step 5 – Pay a Filing Fee

Once you have completed all the paperwork, you will pay a filing fee of $125 to file your LLC with the state of Florida.

Step 6 – Create Your FL LLC Operating Agreement

The next step would be to prepare your FL LLC Operating Agreement – use this lawyer written Operating Agreement template to make your life easy.

This way, you don’t have to worry about creating your own operating agreement – everything is done for you!

Step 7 – Obtain an Employer Identification Number (EIN)

An Employer Identification Number (EIN) is a nine-digit number which the Internal Revenue Service (IRS) uses to identify businesses, including Limited Liability Companies (LLCs).

An LLC must have an EIN in order to pay taxes and open a business bank account.

Once you have received your EIN, it is important to keep it in a secure location as you will need to provide it to the IRS for tax purposes and other official business operations.

Step 8- Open Business Bank Account for Your LLC

The last step is to make sure you open up a business bank account for your LLC. It is important to have a separate business bank account for your LLC, as this will help you keep personal and business expenses separate.

Do not ever mix your personal and business expenses or start paying for personal expenses from your business account or vice versa otherwise you risk losing your limited liability status.

Having this separate account will also make it easier to track your business income and expenses, which is important for filing taxes.

Here are 7 more essential tax tips for you!

Also, check out these 18 best books on taxes to learn more.

How Should Your Florida LLC be Taxed?

The taxation of an LLC in Florida depends on your choice and specific financial situation. You could elect to be taxed as an S Corp for example if that helps you save on self employment taxes.

Make sure to check with your CPA and accountant to decide on how your Florida LLC should be taxed

Statement about taxes

It’s also important to include a statement about taxes in your Florida LLC Operating Agreement so that all members are on the same page.

Florida LLC Operating Agreement FAQs

Below are answers to some common questions I get as a lawyer on Florida LLCs and Operating Agreements:

Where do I get an LLC Operating Agreement in Florida?

As a business lawyer practicing in Florida for over a decade, I have helped thousands of business owners with the legal side of their business and have also put together an LLC Operating Agreement template here that you can instantly download!

This Operating Agreement template works for both member or manager-managed LLC’s.

You can easily plug in your detailed information about business and can begin using it right away, saving you a lot of time and money.

Instead of hiring an expensive lawyer to draft a custom LLC Operating Agreement (which you can certainly do here since I offer that service), with this template, you will get the same level of legal protection at a fraction of the cost!

And if you want to save MORE money, grab my discounted VIP legal bundle here, which includes this LLC Operating Agreement as well as 16 essential done-for-you legal contracts and templates you’ll need at different stages of your business along with 16 incredible bonuses!

Does an LLC Operating agreement need to be notarized in Florida?

No, an LLC Operating Agreement does not need to be notarized in Florida. It is recommended that you have your Operating Agreement signed by all of the members of your LLC and have it witnessed. You should make sure your Operating Agreement is dated and signed by all members for legal purposes.

Do I Need to Post the Florida LLC Operating Agreement on my Business Website?

No, your FL LLC Operating Agreement is a written contract that you keep for your business records. You do not need to post it online on your website.

Should an LLC with only one Member Still Have an Operating Agreement in Florida?

Yes, even a single-member LLC in Florida should have an operating agreement.

As the sole member of the company, you should create an operating agreement and document all decisions, rights, roles, responsibilities, and ownership interests in order to protect your business.

An operating agreement will also serve as evidence that your business is indeed separate from your personal assets.

Can I write my own Florida LLC Operating Agreement?

Writing legal documents is not easy and because these are legally enforceable documents, you cannot afford to make any costly mistakes.

If you decide to write your own Florida LLC Operating Agreement, make sure to thoroughly research the laws and regulations pertaining to forming and operating an LLC.

To save you the time, money, and headaches, I recommend grabbing this LLC Operating Agreement (that’s written by a lawyer) and includes all the important legal provisions to protect your LLC.

If you need help, you should consult an attorney to help you write your own Florida LLC Operating Agreement. They can review any existing agreement and ensure that it is in accordance with state laws.

Additionally, an attorney can make sure that the Operating Agreement is tailored to your individual situation. If you need a custom drafted LLC Operating Agreement, you can book that service and schedule a call with me here.

Avoid these 13 most costly legal mistakes in your business. Watch the video below to learn more and please subscribe to my YouTube channel, if you haven’t already:

What is the difference between an LLC and an Operating Agreement?

An LLC (Limited Liability Company) is a type of legal entity formed under state law.

The LLC provides its owners, who are referred to as “members”, with personal liability protection and the ability to manage their own business affairs.

An Operating Agreement is an internal document created by members of an LLC that outlines the rights and obligations of each member and govern the business affairs of the LLC.

An Operating Agreement is not always required by law, but it is highly recommended to create one in order to ensure that each member understands their rights, responsibilities, and expectations within the LLC.

The Operating Agreement will also provide a clear understanding of how decisions are made and what actions are necessary to protect the LLC from potential legal liability.

The Operating Agreement should be reviewed and updated whenever a major change occurs in the LLC, such as admitting new members or modifying the initial agreement.

Both an LLC and an Operating Agreement are important documents when starting and managing a business, however they serve two different purposes – one is designed to protect you legally while the other outlines the internal rules of the LLC.

Florida LLC Operating Agreement Relevant Forms and Resources

Here’s the Florida LLC Operating Agreement Form you’ll need, which you can easily customize to fit your company’s needs. This LLC Operating Agreement template can be used in any state.

And if you want to save even more money and time, check out our discounted legal bundles, particularly the VIP legal bundle here, which gives you the MOST bang for your buck.

Below are some more helpful blog posts and resources on LLC’s and taxes that you should check out:

- What’s an LLC and when to form one?

- Top 7 Tax Tips Every Business Owner Needs to Know

- Tax Saving Forms

- CPA Solution Membership to get all your tax and accounting questions answered!

- Get The Simple SORT Handbook: The New Entrepreneur’s Roadmap to Setup, Operate, Record and Tax Slay a Successful Business

- AI writing tool to write blog posts 10x faster, create social media content, videos, and any kind of content to save time in business

- This SEO tool to make sure your blog posts rank on the first page of Google

- Free SEO Masterclass to learn how to optimize your blog posts for SEO to rank on Google. You can also buy this awesome bundle of ebooks instead if you prefer ebooks over video training.

- Best accounting software to manage profit and loss and more!

- Best payroll service (super affordable too)

- A great all-in-one business platform for email communications, sales pages, and more!

Related Blog Posts to Florida LLC Operating Agreement (Sample)

In addition to the Florida LLC Operating Agreement, you might be interested in learning how to legally protect your business other ways.

You’ll find my most helpful blog posts and videos on my legal tips page for answers to your legal questions about online business.

Here are some other helpful blog posts related to growing your blog and business to the next level.

- 16 DIY Legal Templates Every Entrepreneur Needs

- Kartra review (Convertkit vs. Kartra) and 8 Reasons why Kartra is the BEST

- Lawyer’s Guide to ADA Website Compliance – Use this checklist

- 50 Bloggers Like You Reveal Why Free Legal Templates DON’T Protect Your Online Business

- Want to start your own affiliate program or already have one? Protect yourself with an Affiliate Agreement

- 23 Best Writing Assistant Software Tools of All Time!

- 27 Bad Christmas Gifts Nobody Wants

- 17 Most Important Things to Know BEFORE Starting a Blog

Don’t forget to join my awesome Facebook group with over 8,000 incredible entrepreneurs to be part of a community in your blogging journey to share personal experiences and get professional blogging help.

This is a very informative article. I am currently in my first year of BBA and I love learning about LLC

Thanks, Marianne. Glad this post helped you!