Should I form an LLC for a blog? As a blogger, you are probably wondering whether you need an LLC for your blogging business.

As a business lawyer and blogger myself, this is the most FAQ I get from bloggers:

Table of Contents

Can a blog be an LLC?

The short answer is YES, and in this post, we will discuss in detail the best business structure for bloggers and small business owners.

Spend five minutes looking into how to form a business online and “LLC” will be one of the first keywords you come across.

LLC stands for Limited Liability Company and it’s just one step above sole proprietorship when it comes to its ease of forming, filing, and maintaining it.

Of course, LLCs aren’t the right solution for every business, although they do offer a number of protections beyond what you would have if you chose to blog as an individual (i.e., a sole proprietor).

If you did nothing, meaning you didn’t officially register your blogging business as an LLC, then you’d be considered a “sole proprietor.”

This means you and your business are considered the same in the eyes of the law. There’s no separation between you and your business.

Here’s everything you need to know about how an LLC could help you as a blogger.

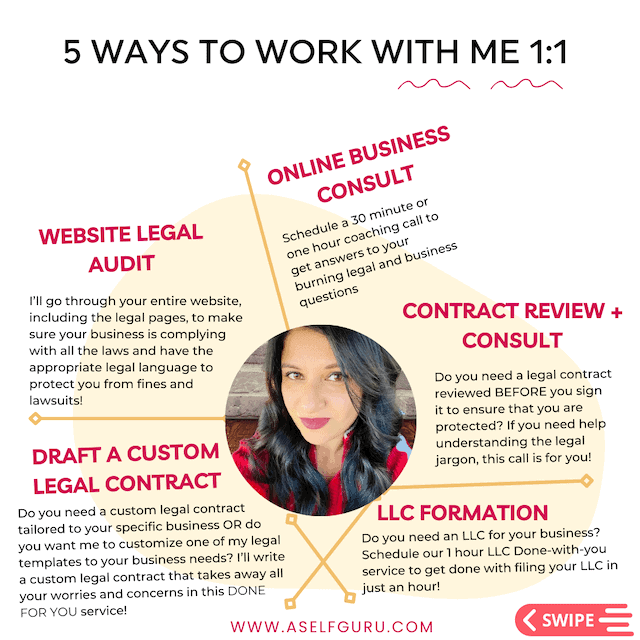

Also, when you are ready, you should work with a lawyer (aka me!) here to form your LLC in just one hour! This is my “Done-with-you” LLC service where you’ll actually get to ask legal questions and learn how to correctly complete and file the LLC paperwork with me.

What is an LLC and How Does it Work?

A Limited Liability Company, or LLC in the United States, combines some features of traditional corporations and partnerships together.

However, LLCs are simpler to manage when compared to a traditional corporation. They also offer more liability protection than individual ownership of a business (which is known as a sole proprietorship).

The owner, or owners, of an LLC are known as members of the LLC.

Member v. Manager LLC (What’s the Difference)

One of the first steps in forming an LLC is to think about how many members or managers your LLC will have.

An LLC can opt to be controlled by its members or by managers that the members select.

The main difference between a member and a manager of a limited liability company (LLC) lies in the level of control they have over the business.

A member is an owner and can make decisions that affect the company, but generally has less control than the manager.

The manager is responsible for making day-to-day decisions regarding operations, finances, and strategy.

They typically have much more control than a member in terms of running the business but that doesn’t necessarily mean they are the owners of the LLC.

Members are owners and may vote on important business decisions such as changing the company’s name, pursuing major contracts, or hiring staff. Each member typically has one vote and decisions generally require a majority vote to pass.

Members also receive profits from the business, but their profits may not be equal depending on how much they have invested in the company.

Meanwhile, a manager is in charge of carrying out those decisions and managing day-to-day operations. Managers typically have more control over the direction the business takes because they are responsible for making decisions about finances, staff and strategy. They are also responsible for managing cash flow and tracking expenses.

In some cases, especially in a blogging business, a member may be the manager of an LLC.

This is common with bloggers and smaller businesses where one person has invested money into their own business and plays a major role in running its operations.

In this situation, it might make sense for that person (blogger) to have both roles – manager and owner.

However, for larger businesses, it is often beneficial to have multiple members and a separate manager so that the business can benefit from different perspectives, skillsets, and experiences.

I know it can be confusing to decide whether you’ll be a member or manager of your LLC, which is why I go over all of that in my done-with-you LLC service here.

Single Member vs. Multi-Member LLC’s For Bloggers

Most bloggers will form a single-member LLC because they operate their blog on their own.

However, if you have someone who regularly contributes to your blog (like a spouse, friend, family member, or co-owner), they should be part of your LLC.

Whether you operate a single-member LLC or multi-member, you will need an LLC Operating Agreement for your business.

As a multi-member LLC, you will certainly need an Operating Agreement, and you’ll also need to choose a tax structure since you have more than one member.

A single-member LLC, on the other hand, can operate as a pass-through entity, where all income your LLC earns goes directly to the sole LLC member, who files taxes just like a sole proprietor would.

Of course, even as a single-member LLC, you may be able to register as an S-corp or C-corp for tax purposes. These structures require additional filing, but they may give you tax advantages, too.

It’s best to speak with your accountant to find out which option works best for you.

LLC Operating Agreement: Why it’s a MUST for your Blog LLC

How your blog LLC is controlled will be set forth in your LLC Operating Agreement, which is always needed and sometimes required by the state when you form your LLC.

Typically, selecting one or two people to manage your LLC will work best. You can select members or non-members to be your LLC’s manager(s).

For example, if you are the sole owner of your blogging business then you’d be the sole member of your LLC.

Beyond explaining who will manage your LLC, your LLC Operating Agreement will also detail some other aspects of your LLC’s operation.

If you have a multi-member LLC, meaning someone other than yourself will be part of your LLC, you’ll definitely want to make sure that your LLC Operating Agreement covers certain things, like how you’ll handle a situation where one or more owners want to exit the LLC.

This legal contract between you and the LLC serves as evidence that your LLC is indeed separate from your personal assets.

So God forbid, if you ever receive a court order or get into legal trouble, you will be required to show this LLC Operating agreement.

LLC vs. Sole Proprietorship

Now let’s talk about the key differences between an LLC and sole proprietorship because as a business lawyer and blogger, many bloggers ask me this question in my Facebook group all the time!

If you start a blog and begin generating revenue from it, you must report that revenue to the IRS as part of your annual tax return.

That means you’re officially in business and, by default, you’re operating your blog as a sole proprietorship. You don’t need to register with anyone to be a sole proprietor because it’s not a separate legal entity from yourself.

Pros and Cons of Sole Proprietorship

If you’re a sole proprietor, one of the big cons is that you are directly and personally responsible for everything to do with your blog/business.

You even report your blog’s revenue on your personal income tax return. Because of this, there are no annual fees to become a sole proprietor, but you can’t have employees as a sole proprietor, either.

Per the IRS rules, as a sole proprietor, you’d need to obtain an Employer Identification Number (EIN) if you need to hire employees other than an independent contractor (freelancer). Here’s the freelance writer contract template you’ll need to work with a new client.

So in other words, the big pro of being a sole proprietor is that it’s easy and you don’t have to file anything at the state level besides paying your income taxes.

Here are 18 best books on taxes that you can check out too.

Is DBA and Sole Proprietorship the same?

No, DBA and Sole Proprietorship are not the same. With that said, those who operate as sole proprietors will sometimes establish a DBA (“doing business as”) with their county clerk’s office.

This ensures no one else uses your name to do business in the county and lets you open bank accounts, credit cards, and even small business loans using your assumed name (i.e., the name of your blog).

However, even if you register and use a DBA, you are still personally responsible for everything you do.

A sole proprietorship offers absolutely no legal liability protections.

It also offers very little privacy. In contrast, just as “limited liability” implies, an LLC limits a member’s liability to the amount they have invested in the LLC. That means you’re not personally liable for the LLC’s debts.

As an example, if a sole proprietor takes out a small business loan and defaults on it, debtors can pursue the individual’s car, home, and other assets to satisfy their debts.

If an LLC defaults on a loan, the members are not personally liable for repaying it.

So these key differences between an LLC for bloggers and sole proprietorship are crucial. Forming an LLC for your website and blogging business may be worth your time!

While we are talking about LLC’s, make sure to grab your FREE legal guide to avoid 3 other common mistakes I see bloggers and entrepreneurs making all the time! Sign up below.

LLC for Bloggers: When should you form your LLC as a blogger?

Think of an LLC as car or home insurance. We buy a car or home insurance as added security to protect ourselves from disasters and lawsuits.

Similarly, an LLC for your blog provides you with that added layer of protection for your business.

It means when something goes wrong or if you get sued, your personal assets like your home, car, or checking account are safe and protected.

There’s no “right time” for it. It comes down to your risk tolerance. It doesn’t matter how much money you are making in your blogging business.

Over the years, I have formed LLCs for BOTH types of bloggers and small business owners: business owners who were just getting started with their business or blogs AND others who were already making money blogging and wanted to protect their personal assets.

As you can already begin to imagine, establishing an LLC truly offers a great deal of confidence when it comes to running your blog as a business. Ultimately, it’s going to offer that extra layer of protection in case anyone ever tries to sue you.

6 Legal Issues for Bloggers (Here are some examples)

As a business lawyer practicing for over a decade, I have seen many bloggers get into all sorts of legal trouble. Below are some examples of legal issues that a blogger can face.

- Any blog can be sued for copyright infringement

- Blogs that write about others can be sued for slander or libel

- Blogs can get into legal trouble for not posting a proper Privacy Policy. You are legally required to post one on your blog.

- Blogs need extra protection if they offer advice or courses (that’s one of the big reasons why you need a blog disclaimer too!)

- Blogs also need extra protection such as proper terms and conditions if they sell products or services

- Blogs can be sued for trademark infringement when you use a trademarked business name, logo, or slogan without permission. Trademark infringement is illegal and can result in costly lawsuits for the blogger who infringes on the trademark

and more!

Ultimately, you’re at the highest risk if you give advice, offer courses, or sell/recommend products as you’re liable for every word you write.

However, any blog can be sued for copyright infringement, and copyright laws are complicated.

Some bloggers form an LLC right away when they start their online business while others choose to wait and see how their business will progress and make money before making this time and money investment.

I formed my LLC when I started making $1000 a month but that was in the first month of my business (very early on) as you can see my blog growth here.

You don’t have to wait until you reach the $1000 per month.

So whenever you are ready, you should start thinking about forming an LLC using this service for your blog to shield yourself from personal liability or book my done-with-you LLC service here.

1-Hour Done-With-You LLC Service (With a Lawyer)

In my done-with-you LLC service, you’ll actually share your screen with me, and I will walk you step by step through completing the paperwork correctly, so you will actually learn how to do that on your own (for your future businesses!). Plus you’ll be done with your LLC in just one hour!

If you are serious about treating your blog as a business and it’s more than a hobby for you then you should consider forming an LLC as soon as you start making consistent income every month. The amount you make doesn’t matter.

This is because it doesn’t matter whether you are making $1,000 a month or $100,000 a month – you both are taking the same risk of being personally liable for your business losses, debts, and lawsuits!

It’s really a small investment in my eyes for that added peace of mind knowing your personal assets are safe and protected. But at the end of the day, forming an LLC for your blog is truly your preference.

5 Advantages of an LLC for bloggers

We’ve already touched on a number of advantages that come with forming an LLC as a blogger, but here’s a quick summary of the primary benefits.

-

Less risk of an audit:

You’re less likely to be audited as an LLC than a sole proprietorship when you file your taxes.

-

Personal asset protection:

Your personal assets (home, personal checking account, car, etc) will be protected.

-

Privacy:

Having a registered agent for your LLC gives you a business address and point of contact so you don’t have to publish your personal information.

-

Limitation of legal liability:

LLC provides a shield of legal protection so if your blog or business is sued, you are not personally liable for the debts and losses.

-

Look like a Professional and Credible Business:

Forming an LLC helps you present yourself in a more professional and credible manner. If your blog is your business, treat it like one!

Depending on the tax structure you use for your LLC (pass-through, S-corp, or C-corp), you may also enjoy certain tax advantages alongside its formation.

Consult your CPA or accountant for more specific tax advice because each blogger’s tax and financial situation will look different! Here are some time-saving tax forms you’ll need.

DBA vs. LLC for Bloggers

As we’ve covered, DBA stands for “Doing Business As.” It’s also called a “fictitious name” in different states.

You can register a DBA with your county clerk at any point, whether you have an LLC or not. Those with an LLC can also register additional DBAs under their LLC if their business name is different.

DBA Example

For instance, if you have an LLC by the name of Claire’s Creations, LLC and you’d like to also conduct business under a different name as Claire’s Confections, you’d need to take the important step of registering that name with your county clerk.

You’d then be legally presenting yourself as Claire’s Creations, LLC DBA Claire’s Confections.

Ultimately, if you’re trying to decide if you need a DBA or an LLC, you need to consider what your blog publishes and the potential liabilities you’re taking on. Selling or promoting products, reviewing other people’s products as an affiliate, discussing people and businesses, and so on can all get you in hot water.

If you think you could potentially be part of a lawsuit for something you post, you should definitely form an LLC.

LLC v. S Corporation (or S Corp)

LLC’s and S Corps are different.

The LLC, or limited liability company, is a business structure that involves members having limited personal liability for the debts and obligations of the LLC.

On the other hand, an S Corporation is a type of corporation that you can elect to be taxed under Subchapter S of the Internal Revenue Code.

You could be an LLC and then make a tax election to be taxed as an S Corp to save money on self-employment taxes.

Both structures are beneficial but offer different advantages – LLC for limiting your legal liability and S Corporation for tax savings.

It’s always best to consult with your accountant or CPA to make sure whether it makes sense to form an S Corp or not.

How to Form an LLC for Your Blog

Forming an LLC isn’t all that difficult, although the process differs slightly from state to state.

You can hire a lawyer like me for added peace of mind to make sure your paperwork is done correctly.

You will submit all of your forms to your state’s office, but these are the general steps to follow:

1. Decide where to register.

Many people don’t know it, but you actually don’t have to register your LLC in the state where you reside although it’s best to register where you live otherwise you end up paying a lot more filing fees such as getting a registered agent service.

2. Decide on a name.

You can always change your name, but that usually incurs a filing fee.

You need to choose a name and then check your Secretary of State’s business name database to make sure it’s available.

Pro Tip: You’ll need to use “LLC” or “Limited Liability Company” at the end of your name.

3. File your Articles of Organization

You are required to file Articles of Organization with your Secretary of State. You’ll be able to find this form online. Some states allow you to file it online, too, while others require you to mail it in.

Pro Tip: State fees for filing vary. It’s $100 in places like South Dakota and $300 in places like Texas. You only have to pay this fee once and then annual fees afterward to keep your LLC.

4. Create an LLC Operating Agreement.

Some states require you to include a copy of your operating agreement with your filing, others do not. Grab my LLC Operating Agreement template here to make your life easy!

With these few steps, you have officially formed an LLC for your blog!

Now it’s time to do your due diligence. Every state has different requirements, so you should check with your state to find out if you have an annual report you need to file and if there is a fee associated with it.

Additionally, if you do not live in the state or if your state does not allow you to be your own registered agent, you’ll need to get a registered agent service (I recommend this).

Prices range from $39 to hundreds of dollars a year depending on the other services they offer (like mail forwarding).

A registered agent is a legal resident of the state where your LLC is registered. This agent has an address you will use on your correspondence and they should be at this address during normal business hours and able to accept legal documents on your behalf (including subpoenas).

5. Obtain an EIN number.

You should get an EIN number for your LLC because it will help you with your tax and legal responsibilities.

An EIN is a unique nine-digit number that identifies the business to the IRS. It is used to report taxes, open a business account, hire employees, obtain business licenses and permits, or apply for certain types of financing.

Having an EIN can also protect your personal information from the public record where you don’t have to use your social security number anymore and instead use your EIN to identify you as a business owner.

Additionally, having an EIN allows you to open a bank account in the name of your business and accept payments from customers or clients.

If you plan to do any kind of business in the US, regardless of your size or type, it is a good idea to get an EIN for your LLC.

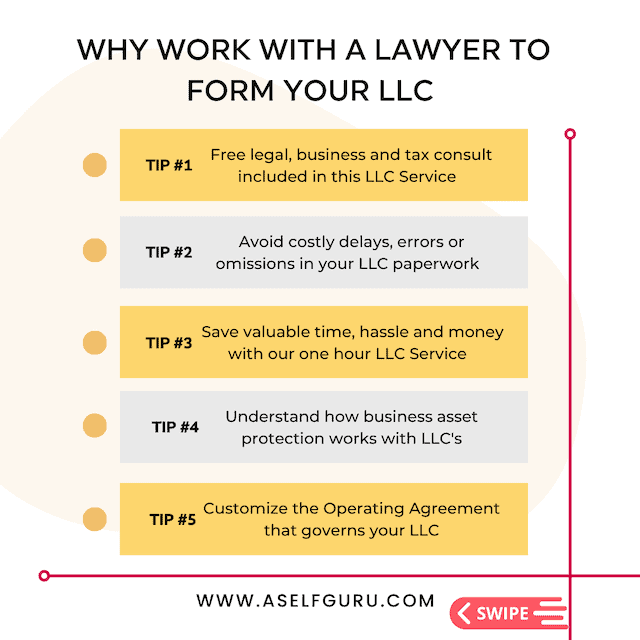

5 Big Reasons to Work with a Lawyer to File your Business LLC

As a business lawyer, I have seen many bloggers make mistakes in filing their LLC paperwork or they hire a service like Legal Zoom, which is known to make mistakes.

Different states have different requirements.

Each state has its own unique LLC forms and requirements; so it’s best to work with a lawyer to make sure your LLC paperwork is filed error-free.

My 1 Hour Done-with-you LLC Service (Step-by-Step Guide to Forming an LLC)

For example, I offer a Done-with-you 1-Hour LLC Service where you and I work together to file your LLC correctly in just an hour! Plus you get free legal, business and tax tips and actionable advice not found anywhere else.

You also avoid costly delays, errors or omissions in your LLC paperwork, and save tons of time, hassle and money down the road.

I will also explain how business asset protection works for your new LLC and what are some of the important next steps you need to take to keep the legal shield of protection for your personal assets.

Also, as I mentioned above, your LLC Operating Agreement is an integral part of your LLC – this is the legal document that governs your LLC and serves as evidence in court stating how your personal assets are separate from the business.

So we will customize this agreement to your business during my LLC service here as well.

Do You Need a Business License for your blog?

Most bloggers don’t know it, but the majority of states require bloggers to obtain a general business license. However, most bloggers do not need to get a federal license to run their blogs.

You’ll need a business license if you rent, lease, or sell goods through your blog or if you provide a taxable service on your blog. If you’re selling goods or services, you may need a sales tax permit from your state as well.

Additionally, if you operate out of your own household, as most bloggers do, you’ll potentially need a Home Occupation Permit. You may also need to get an Employer Identification Number or EIN for your blog, depending on how you file your taxes.

Check your state’s business license requirements here to make sure you are complying with them.

LLC Operating Agreement Template For Blogs

Your LLC Operating Agreement is one of the primary pieces of paperwork you’ll need to put together in order to set up your LLC.

I offer a handy template here to get you started, which will ensure you include everything you should have in your agreement.

Without the LLC Operating Agreement, you cannot prove that your blogger LLC is indeed separate from your personal assets. It’s this agreement that serves as evidence should you get sued tomorrow. So it’s quite important and not something you should neglect even if your state doesn’t officially require you to file it.

You still need to have this Operating Agreement as part of your business records as proof.

Learn more about it here.

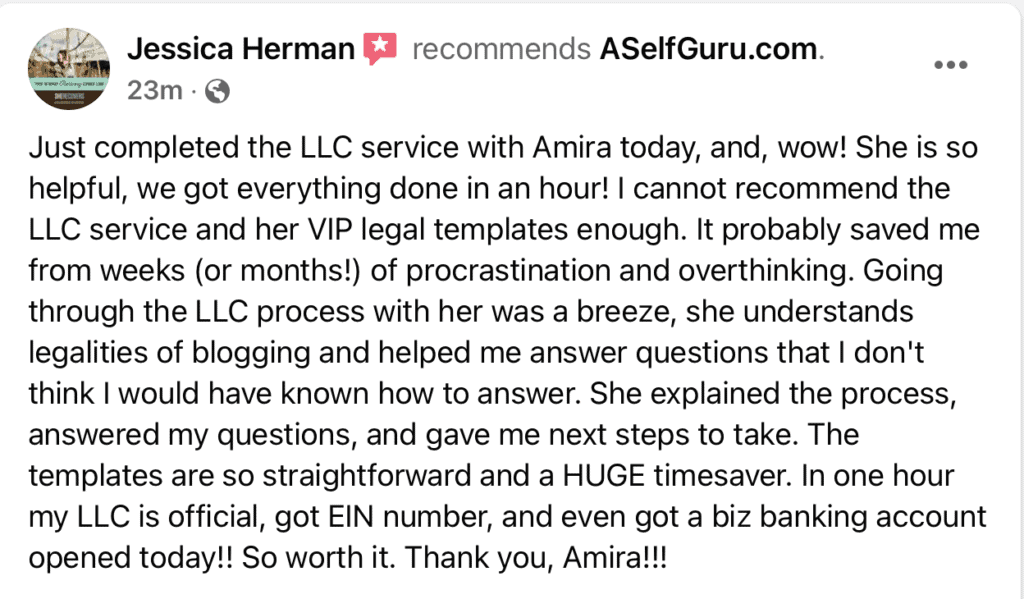

Lastly, here are 100+ 5 star reviews of my legal templates including this LLC Operating Agreement template on my Facebook page.

How to Make Sure You are Blogging Legally

There are so many complex laws regarding small businesses and blogging that it can be overwhelming.

That’s why I offer important legal templates for bloggers here, who are serious about treating their blog as a business and want to make sure they are within the law!

Aside from registering your blog as an LLC, you also need to make sure you have these 3 legal pages (privacy policy, disclaimer, and terms and conditions) on your blog to comply with privacy laws and protect your blog from lawsuits.

Learn all about them in this helpful video and please SUBSCRIBE to my YT channel for more legal, blogging and business tips to help you succeed!

Also, here are 3 important blog posts to help you learn about your legal requirements in addition to LLC for bloggers:

- You Must Have 3 Essential Legal Pages on Your Blog BEFORE you launch. Find out all about them here.

- You Must Use Proper Legal Contracts to Protect Your Blogging Business from ugly disputes. Confused about which legal contract you need and when? This blog post will help!

- Find out why 50+ Savvy Entrepreneurs and Bloggers Like You DON’T Trust the Free Legal Pages and Templates to Protect Their Blogs

FAQ on LLC for Blogs

Below are some common questions that I answer about LLCs.

Should I form an LLC for a blog?

Generally speaking, as mentioned above, there are good reasons for forming an LLC for a blog or new business.

LLC is a popular choice because it is one of the business entities that are easy to form and maintain as compared to other complex business entities.

The main reason bloggers form an LLC is to limit their personal liability in the event of legal action.

The LLC protects the owners’ personal assets from being taken in a lawsuit by separating business and personal assets.

This separate business entity also helps establish credibility with customers, banks, investors, and other partners since it is recognized as a legitimate entity.

Forming an LLC for a blog is something that you should consider depending on the type and size of your blog. LLCs offer important benefits such as protection from personal liability, tax savings, and ease of transferring ownership.

For example, if you’re running a large blog with multiple business partners, forming an LLC can help protect each owner’s personal assets from any legal issues that might arise.

In addition, LLCs provide tax benefits such as pass-through taxation and limited liability for the owners, which can help reduce the overall tax burden of running a blog.

Additionally, if you ever decide to sell your blog or transfer ownership in some way, forming an LLC ahead of time can make that process much easier.

Overall, an LLC is not necessarily required for a blog, but if you are concerned about legal action and want to protect your business assets as well as personal accounts then consider forming an LLC (with help from a lawyer).

Do your research and consult with a lawyer if you need to in deciding if forming an LLC is right for your blog.

Do I have to register my blog as a business?

Registering your blogging business may be necessary to open a business bank account or apply for certain types of taxes.

It is important to note, however, that the process of registering a business varies depending on where you live, so it is best to consult with a qualified professional or local government office to determine the best course of action for your particular situation.

In addition to registering your business, there are other steps you can take to ensure that your blog becomes a successful business.

This includes setting up basic infrastructure such as an email address, hosting account, and website design platform; researching and investing in keyword research and SEO optimization; and creating engaging content that appeals to your target audience.

With the right steps in place, you can create and maintain a successful blog that generates income for years to come. All of these tips will help you make more money blogging.

Finally, it is important to remember to stay compliant with all applicable local laws and regulations in order to protect yourself and your business. This includes researching any applicable laws and regulations in your jurisdiction, as well as keeping track of any state taxes or fees that may be associated with running your business.

Do I need an LLC as a writer?

Again, you don’t need an LLC as a writer but forming an LLC is a great way to limit your legal liability. As content creators, there’s always a risk of making mistakes or publishing content that can be misinterpreted or causes harm.

That said, forming an LLC is not the only option available to writers. If you plan to operate as a sole proprietor or partnership, you may still benefit from other forms of legal protection and may be able to take advantage of deductions and tax breaks that are available only to certain types of businesses.

If you have a business partner, learn more about partnerships and the contract you’ll need in this blog post.

Final Thoughts – LLC for Bloggers

Most bloggers are completely unaware of all the potential legal ramifications of what they do with their online businesses.

The fact is, it’s not a quick way to make a buck. As you already know, blogging takes a great deal of work, so if you’re going to run it like a business, you need to establish it as one!

LLC for blogs is an essential part of doing business to protect your personal assets.

At the end of the day, bloggers who form an LLC typically end up breathing a BIG sigh of relief as my customers here.

Of course, there’s always more to consider. I suggest exploring some related posts on this blog like this one to help make sure you’re not blindsided by the laws or requirements that may impact how you blog.

Make sure to join my Facebook group here to get more blogging legal tips for free!

Related Blog Posts on LLC For Blogs and Blogging Legally

If you are wondering what else you need to know about the legal side of blogging and how to protect yourself, then check out this legal tips page and these helpful blog posts:

- Florida LLC Operating Agreement Template (sample from a lawyer)

- What Is a Media Release Agreement and How to Use It?

- The Only Guest Blogger Agreement Template You Need for Your Blog

- What Is a Confidentiality Agreement and Why You Must Use It (NDA Template)

- Coaching Agreement and Contracts You Need for Your Coaching Business

- 16 DIY Legal Document Templates for All Entrepreneurs

- Sweepstakes Template, Giveaways and Contest Terms and Conditions

- 3 Legal Pages and Legal Contracts for Bloggers and Entrepreneurs

- Affiliate Agreement: Why Do You Need It for Your Affiliate Program?

- 15 Freelance Contract Template Essentials You Need to Know

- 50+ Savvy Entrepreneurs Reveal How They Protect Their Business

Have you formed an LLC for your blog or are you thinking about it? Let me know in the comments below!

Wonderful info as always Amira! Thank you.

You are welcome, Craig! Thank you for stopping by my blog 🙂

I’ve really been debating forming an LLC lately. I think I need to so this post really helped me understand the difference between and LLC and sole proprietor. Knowing when to get an EIN is also quite helpful. I see more of your templates in my future soon!

Awesome, that’s so great to hear, Heather!! I know tons of bloggers have the same legal questions, so I’m glad this post helped you!

So much informative info! So excited to be able to learn from you more!

Aww thank you so much! Glad this post helped you!

This was really helpful as I have to confess I do find legal jargon terribly confusing so I am going to bookmark this for later. It was useful to know that as bloggers we are a sole proprietor.

Thanks, Ana! So glad this blog post helped you and I totally understand the legal overwhelm. As a blogger, there’s so much to do and learn 🙂

This is so helpful! I’m going to be looking into turning my blog into an LLC soon and I’m definitely going to be coming back to this.

So glad this post helped you, Sara! Thank you for stopping by my blog 🙂

Hello Amira! Thank you for your templates they were super affordable. I have a question regarding the topic of your post. I want to form an LLC, but I want to inquire about the services I will be providing through my business. I want to offer classes and sell products. I have names for those the classes for example “thought sessions” and “thought boxes” When I establish my LLC will the names I have established be protected, or do I need to establish a copyright for each individual name I have established for my services? I hope that I am… Read more »

Thank you for purchasing my legal templates! Anything you sell from your business is included as part of your LLC. For course names, you’d look into trademarking the name if you don’t want someone else to use and infringe on it.

Thank you!

Very good information that I needed I already send you a few questions, and thank you especially for new bloggers like me.

You are welcome, happy to help!

I did not know that this was possible and necessary. thank you this post helped me to understand this subject better

Glad this post helped you, Pamela! Thanks for visiting my blog 🙂

Hi Amira, thanks for this post and your operating agreement template. My spouse and I are forming an LLC for our blog in a community property state, but we live in a non-community property state. We will both be owners/members. Can we treat the LLC as a single-member LLC (use single-member LLC operating agreement and state this intent) since it was formed in a state that permits this for married couples? Or is it required that the couple also lives in a community property state? Thank you

Hi Jennifer, since you both will be members of the LLC then it won’t be a single member LLC. So use the multiple-member LLC Operating Agreement in this case – I believe my support team emailed that one to you 🙂

Turning your blog into a business is an exciting and rewarding endeavor that has the potential to open up a world of opportunities. With determination, creativity, and a strategic mindset, you can transform your passion for blogging into a flourishing and sustainable business. The first step is to identify your niche and target audience. By narrowing down your focus and catering your content to a specific audience, you can establish yourself as an authority in your field and build a loyal following. Engaging with your readers, responding to comments, and encouraging discussions will help foster a sense of community around… Read more »

Can you collect funds to start a blog without forming a corp in Florida?

Yes, you can start a blog without forming an LLC. You would be a sole proprietor, which means you and your business are considered the same.