As a business lawyer, I see firsthand the legal issues for freelancers that must be avoided.

I watched my own dad’s business get sued for $90,000 by a freelancer.

It was a long expensive lawsuit between a business owner and a freelancer that could have been easily avoided with this contract.

This incident resulted in me becoming a lawyer so I could help creative freelancers, business owners, and entrepreneurs avoid potential disputes and legal risks.

Navigating legal matters is essential to safeguarding your intellectual property and ensuring smooth client relationships, whether you are a graphic designer, writer, or artist.

Without these, legal complications are bound to occur and you risk financial losses, disputes, or even lawsuits.

So in this article, I will cover key legal issues freelancers must know such as intellectual property protection and the significance of contracts that clearly define the scope of work and ownership rights.

Additionally, I will explain the dangers of using copyrighted material without permission and how to ensure data privacy and security when handling client information.

Table of Contents

7 Primary Legal Concerns Creative Freelancers Face and How to Navigate Them

Creative freelancers offer their creative services independently, without the long-term commitment of working for a single employer.

This group includes writers, graphic designers, photographers, musicians, web developers, and other creative professionals.

They are often hired on a project basis, which allows them the flexibility to work with multiple clients across various industries.

The rise of the gig economy and the increasing demand for digital content are some of the reasons for a growing creative freelance industry.

These creative freelancers often find themselves navigating a complex web of legal challenges that include the following:

1. Understanding Contractual Agreements

One of the first legal issues for freelancers is not knowing which legal contract to use with their clients.

As independent contractors, your first legal obligation to yourself and your client is to use a proper contract.

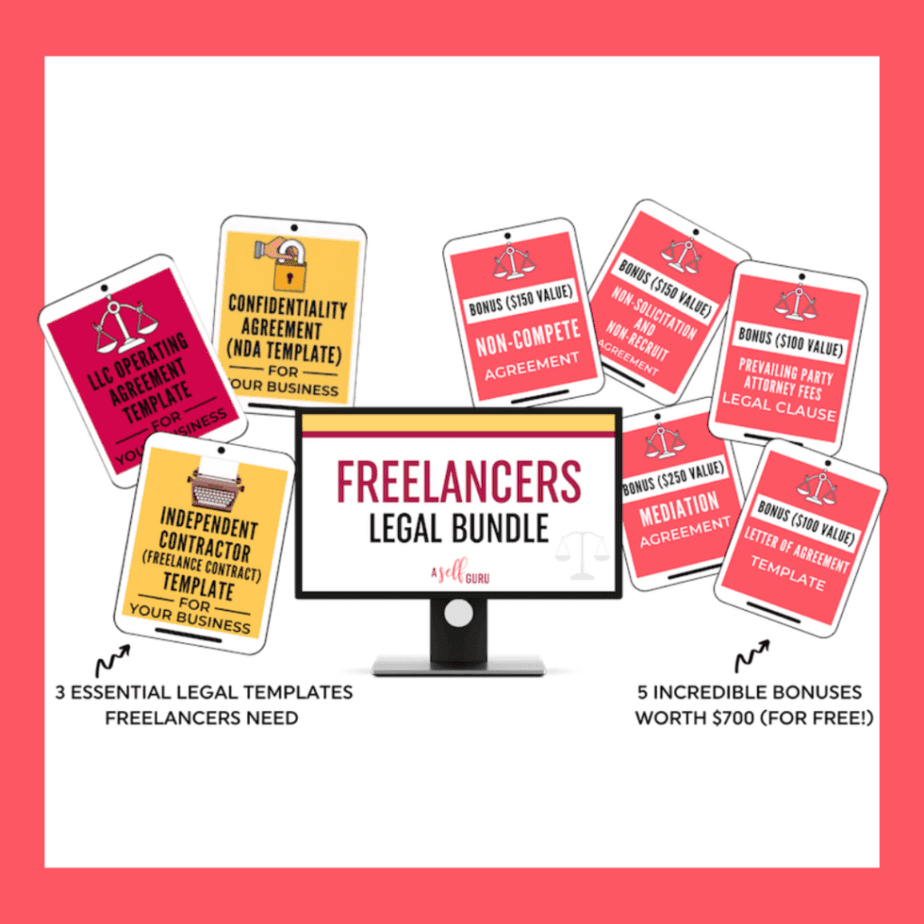

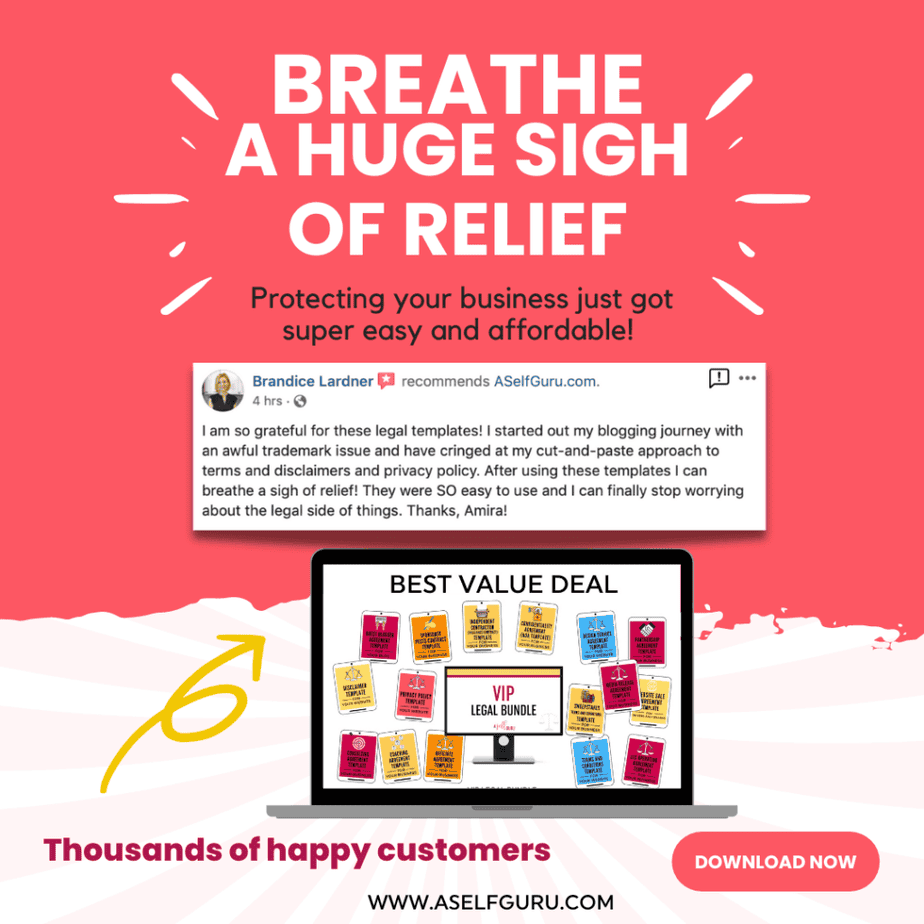

And to make things super easy, I put together a bundle of legal templates for freelancers and clients to work together safely.

Check out this Freelancers legal bundle here.

The Importance of Contracts

Contracts are the backbone of any business relationship.

For freelancers, having a solid contract in place can mean the difference between a smooth project and a legal nightmare.

A well-drafted contract clearly outlines the expectations, responsibilities, and compensation terms for both parties.

It serves as a legal safeguard against misunderstandings and disputes.

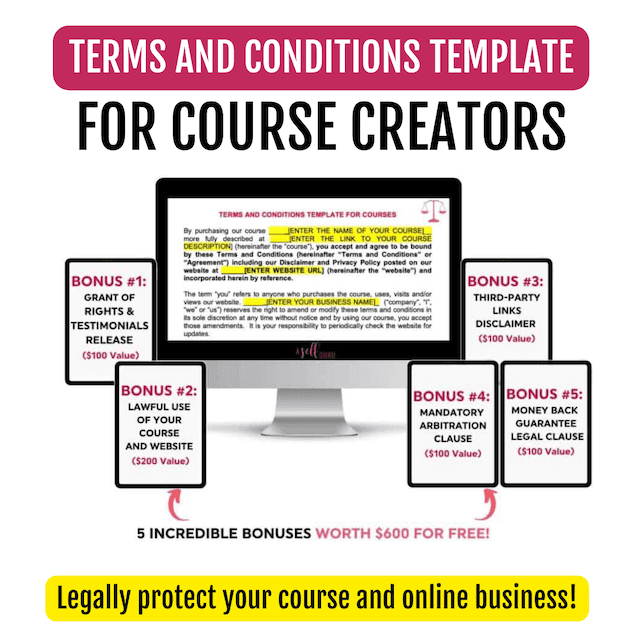

Click to watch this video where I explain in more detail and also offer a template.

Service Agreements (aka Independent contractor agreements)

Freelancers rely on service agreements to formalize client relationships and reduce the likelihood of disputes.

This is one of the key legal considerations you don’t want to miss.

This type of contract is also known as an independent contractor agreement.

Verbal agreements are prevalent in freelancing, but they carry significant risks because it becomes difficult to enforce terms or seek legal recourse if a dispute arises.

This is the reason my dad got sued because he relied on a verbal agreement. So learn from his devastating mistake!

Misunderstandings about deliverables, deadlines, or payment can quickly escalate without a documented agreement.

So the best way to avoid potential legal pitfalls and protect yourself is to always use a lawyer-drafted contract.

If you don’t want the full bundle (which you need by the way), you can still grab the individual Freelance contract template here.

This will give you the agreement template you will need to use with your clients to outline the terms of the working relationship.

Essential Clauses in Freelancer Contracts

Your contract should include essential clauses such as scope of work, payment terms, intellectual property rights, confidentiality agreements, and termination conditions.

These clauses protect your interests and provide a clear framework for the project.

Ensure that both parties understand and agree to these terms before work begins.

Common Contract Mistakes

One common mistake freelancers make is using generic, free or one-size-fits-all contracts.

Another pitfall is not updating contracts for each project, which can lead to outdated terms that don’t reflect the current agreement.

Always tailor your contracts to each specific project and client to avoid potential legal issues.

Related Post: 15 Documents Needed to Sell a Business – Checklist

11 Top Tips to Boost Law Firm Efficiency

What to Include in a Freelance Contract

A written contract ensures both parties understand their responsibilities, offering a strong basis for conflict resolution.

To avoid financial disputes, a well-drafted service agreement should include several critical components:

Revisions and Ownership Rights

This clause clarifies the number of revisions included and who retains ownership of the final work.

When dealing with personalized goods, specify whether the client owns the product or if it remains licensed to the freelancer.

Any freelancer offering custom works, for instance, laser engraving or handmade crafts, should outline how many changes the client can request before the work begins.

Rerunning equipment such as a wood laser cutter or reordering raw materials for the revised design has costs that will cut into your margin if the clause is unclear about revisions.

In addition, the service agreement should clarify whether the client gains full ownership of the engraved item or if the freelancer retains certain rights.

Scope of Work

This section outlines what will be delivered and by when.

It sets clear expectations for both parties, preventing scope creep, which occurs when clients expect more than agreed upon.

Payment Terms

Freelancers should detail the payment schedule, methods of payment, and penalties for late or non-payment.

This transparency ensures timely compensation and minimizes the risk of disputes over fees.

Termination Clause

Outlining the conditions under which either party can end the agreement protects a freelancer and client from unexpected cancellations or delays.

Confidentiality Clause

These clauses prevent freelancers or clients from sharing proprietary or confidential information with third parties.

Should confidentiality be breached, the agreement provides a legal framework for pursuing recourse, potentially including damages or the termination of the contract.

Licensing vs. Assignment of Rights

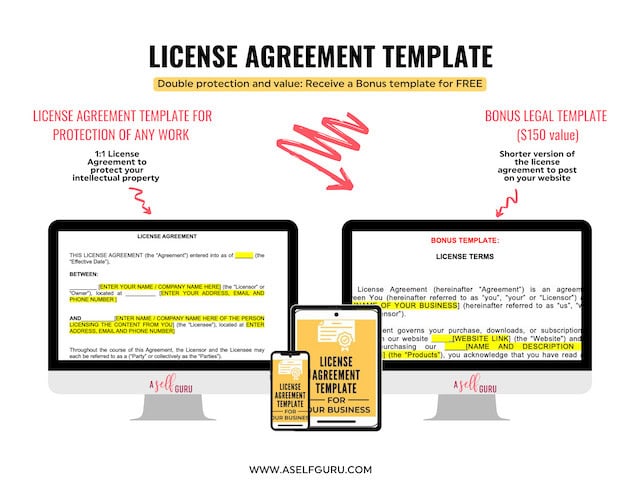

Freelancers can either license their work—granting clients usage rights while retaining ownership—or assign all rights to the client.

Licensing is preferable for freelancers who want to reuse their work or maintain control over its use, while assigning rights may be necessary for projects where the client requires full ownership.

However, assigning all rights can limit future opportunities to profit from the creations.

Whatever you decide, make sure to use this License Agreement that actually protects your interests.

2. Issue of Intellectual Property

Intellectual property (IP) rights are crucial for freelancers, especially those in creative fields.

IP laws protect your original work, whether it’s a design, a piece of writing, or a software program.

Knowing your rights helps you safeguard your creations and ensures that you receive proper credit and compensation.

Copyright law grants creative freelancers legal protection over their original works, including designs, music, writing, or artwork.

It secures exclusive rights to reproduce, distribute, and display it.

Copyright infringement happens when someone uses a copyrighted work without permission.

It includes copying images, music, or written content for personal or commercial use without obtaining the necessary licenses.

Creative freelancers risk unintentionally violating copyright when they use materials found online. Doing so, even unknowingly, can lead to legal trouble.

Sign up for my free legal guide for business below to learn more.

Understanding Intellectual Property and Fair Use

Many misunderstand fair use.

This can be one of the most costly legal issues for freelancers.

While fair use allows limited use of copyrighted material for commentary, criticism, or education, it imposes strict limitations.

Freelancers must carefully assess whether their use qualifies under fair use, considering factors like the purpose of use and the amount of content used.

Misinterpreting this can lead to copyright infringement.

Consequences of infringement include lawsuits, heavy fines, and harm to professional business reputation.

Freelancers should always secure proper licensing or use royalty-free content to stay compliant.

I also recommend booking a call with a lawyer like me to discuss your specific questions or concerns instead of proceeding without caution.

Trade Secrets and Trademark

Another issue of concern for freelancers is trademarks.

These cover elements like brand names, logos, and slogans.

For freelancers building a personal brand, securing a trademark is essential to prevent others from using or profiting from your brand identity.

To register it, you need to work with a lawyer first to conduct a name search.

Then submit an application to a relevant government office, and once approved, it legally protects the brand, ensuring only you can use it in your industry.

Oh, one more thing, is your website breaking this law? Prevent costly ADA lawsuits with this bundle.

Patents and Potential IP Disputes

Patents apply to freelancers developing new products, designs, or technologies.

If you create something unique, like an innovative design process or tool, filing for a patent can protect your invention from being copied.

The application process is more complex and costly but can be invaluable if your product has the potential for commercial use.

- FYI: Whether you are a WordPress beginner, looking to grow your established WordPress blog, or scaling up to Enterprise WordPress needs, this may be one of the best Managed WordPress Hosting decisions you can make.

Avoiding Infringement

Freelancers must also be cautious about infringing on others’ IP rights.

Always ensure that you have the necessary permissions to use any third-party content in your work.

Using copyrighted material without permission can lead to a costly legal battle and numerous ethical issues.

The legal aspects of intellectual property should be clearly outlined in your contract.

That’s why intellectual property ownership is an important legal provision that I have already included for free in our freelance contract template here.

Make sure to use this Media Release Agreement to get legal rights to use someone’s name, photos, or videos legally.

This agreement gives you the permission to use the copyright holder’s intellectual property.

If you need a license to someone’s content then make sure to use this License Agreement template (written by a lawyer).

Related Blog Posts on Issues for Freelancers

Check out these related helpful blog posts to learn more:

- How to license content and avoid legal disputes

- Lawyer’s guide on AI disclaimer for your website

- 15 Website Legal Requirements Small Business Owners Must Know

- How to Become a Freelance Writer and Make Money From Home

- Freelance contract essential terms you must know

3. Compliance with Tax Laws

As contract workers, freelancers do not work as traditional employees.

They are considered self-employed professionals and need to be aware of the relevant laws.

Understanding Your Tax Obligations

Freelancers are responsible for managing their own taxes, which can be complex and confusing.

Unlike traditional employees, freelancers don’t have taxes automatically deducted from their earnings.

It’s essential to understand your tax obligations to avoid penalties and interest charges.

Also, if you decide to become your own boss by starting an online business then here are some tools worth trying:

- Jasper to create content 10x faster

- AI Originality to check for plagarism

- Rankiq to rank your articles on the first page of Google

- Freshbooks or Quickbooks for your business accounting

- Kartra for your email marketing

- Quillbot to paraphrase text quickly

Keeping Accurate Records

Keeping accurate financial records is vital for calculating your taxes correctly.

Track all your income and expenses meticulously.

Use accounting software designed for freelancers to simplify this process and ensure you have all the necessary documentation for tax filings.

Seeking Professional Advice

Consider consulting with a tax professional to ensure that you’re compliant with tax laws and taking advantage of any deductions available to freelancers.

Additionally, immigration lawyers can provide valuable guidance if your work involves dealing with international clients or navigating cross-border regulations

You should have a basic understanding of self-employment taxes or payroll taxes.

Professional advice can save you time, stress, and money in the long run.

If you’re a U.S. freelancer living overseas, it’s essential to be aware of special IRS programs designed just for expats who need to catch up on their tax filings.

Utilizing a reliable Streamlined Filing package can help U.S. expats properly navigate the complexities of the IRS Streamlined Foreign Offshore Procedures, enabling them to get back into compliance smoothly and claim any eligible benefits—while avoiding common penalties associated with late filings.

4. Maintaining Confidentiality and Privacy

Maintaining privacy is a legal requirement. There are strict privacy laws against the misuse of data.

Data Privacy and Security

Freelancers who collect sensitive client information are legally obligated to ensure privacy and security.

Laws like the General Data Protection Regulation (GDPR) set strict guidelines on data handling, especially for freelancers working with clients in the European Union.

Learn more in this video.

As such, GDPR requires freelancers to ensure that data is collected, stored, and processed securely and mandates consent from clients before using their data.

Failure to comply with such laws can result in hefty fines.

Make sure to post a proper GDPR and CCPA compliant Privacy Policy on your website to demonstrate compliance.

Don’t worry, simply download our VIP legal bundle to get the Freelance contract as well as the 3 website legal pages you need to post.

AND many more bonuses and templates!

Respecting Client Privacy

Respecting client privacy is equally important.

Ensure that you handle client data responsibly and comply with relevant data protection laws.

Mismanaging client information can lead to legal consequences and damage your professional reputation.

Understanding Confidentiality Agreements

Confidentiality agreements, or NDAs (Non-Disclosure Agreements), are vital for protecting sensitive information.

These agreements prevent clients from disclosing your proprietary information and vice versa.

They are particularly important for projects involving trade secrets or confidential client data.

Drafting Effective NDAs

A well-drafted NDA should define what constitutes confidential information, the obligations of both parties and the duration of the confidentiality obligation.

Ensure that both parties sign the NDA before any sensitive information is shared.

It’s a good idea to use this lawyer written NDA template that covers all the important legal provisions to protect you.

This contract template also comes in our VIP legal bundle here.

5. Handling Payments and Invoicing

In addition to a non-disclosure agreement, you need to outline a clear method of payment and be able to send timely invoices to clients.

Setting Clear Payment Terms

Clear payment terms are essential for avoiding disputes and ensuring you get paid on time.

Specify the payment schedule, methods, and penalties for late payments in your contract.

This clarity helps manage client expectations and maintains a steady cash flow.

Protecting Against Non-Payment

Non-payment is a common issue freelancers face.

To protect yourself, request a deposit before starting work and set up milestone payments for longer projects.

This approach minimizes your risk and ensures you receive compensation for the work completed.

Streamlining the Invoicing Process

Streamline your invoicing process by using invoicing software.

Automated invoices reduce errors and speed up payment processing.

Such online invoice generator software can help you create professional invoices in just a few clicks, saving both time and effort.

Include all necessary details on your invoices, such as your payment terms, to avoid any confusion and delays.

You should definitely use accounting software like this one to avoid mistakes.

6. Protecting Your Personal Assets

In your freelance career, you need to think about protecting your personal assets.

In the event your business gets sued, your personal assets should not be at risk.

At first, you will operate as a sole proprietorship unless you form an LLC upfront.

Choosing the Right Business Entity

Forming a business entity, such as an LLC (Limited Liability Company) or corporation, can be crucial in protecting your personal assets as a freelancer.

These structures create a legal separation between your business and personal finances, shielding your personal assets from liability if your business faces legal issues.

Evaluate the different types of entities and choose one that best aligns with your business activities and long-term goals.

- Need your LLC filed correctly in just 1 hour? (plus free consultation with a lawyer) Sign up for our 1-hour Done-with-you LLC service here.

Understanding Liability Limitation

By establishing a separate business entity, you limit personal liability for business debts and obligations.

However, maintaining this protection requires ensuring that you separate personal and business finances.

Use a dedicated business bank account and credit card, and maintain proper corporate formalities, such as keeping detailed records and holding annual meetings if required.

Managing Business Risks

Having a robust business structure in place isn’t the sole measure for protecting personal assets.

Insurance options such as professional liability insurance, also known as errors and omissions insurance, can offer additional protection against claims of negligence or mistakes in your work.

As a freelancer, consider the specific risks associated with your field and obtain appropriate coverage to mitigate potential financial losses.

7. Managing Client Relationships

Setting Boundaries

Setting clear boundaries with clients helps maintain a healthy working relationship and prevents potential conflicts.

Define your working hours, communication methods, and response times in your contract.

This clarity helps manage client expectations and reduces the risk of misunderstandings.

Handling Disputes

Despite your best efforts, disputes can still arise.

When they do, address them promptly and professionally.

Refer to your contract for guidance and aim for a fair resolution. If necessary, seek legal advice to protect your interests.

Building Long-Term Relationships

Building long-term relationships with clients is important for your business success.

Prioritize communication, deliver high-quality work, and show appreciation for your clients.

Positive client relationships lead to repeat business and referrals.

Protect your personal assets with a business entity.

What are the legal obligations of a freelancer?

As a freelancer, you have certain legal obligations that must be fulfilled to maintain a professional and ethical standard of work.

These obligations may vary depending on your industry and location, but some common ones include:

- Paying Taxes: As a self-employed individual, you are responsible for paying income taxes on the income you earn from your freelance work. This includes federal, state, and local taxes.

- Obtaining Necessary Permits or Licenses: Depending on your industry and location, you may need to obtain specific permits or licenses to legally operate your freelancing business.

- Ensuring your website is legal: If you have a website, you need to make sure it’s legally protected to avoid legal trouble, fines, or audits. Start with these legal pages.

- Fulfilling Contractual Obligations: When working with clients, you have a legal obligation to fulfill the terms outlined in your contract or agreement. Failure to do so could result in breach of contract claims.

- Protecting Client Information: As a freelancer, you have a responsibility to maintain client confidentiality and protect their sensitive information from unauthorized access or disclosure.

- Upholding Professional Standards: Freelancers are expected to deliver high-quality work and maintain professional behavior in all business dealings. This includes adhering to ethical standards and avoiding conflicts of interest.

What are the legal protection of freelancers?

Freelancers have certain legal protections in place to help safeguard their rights and interests such as:

- Contracts: Having a written contract in place can provide legal protection for both the freelancer and their client. It outlines the terms of the agreement, such as deliverables, payment, and dispute resolution procedures.

- Intellectual Property Rights: Freelancers own the intellectual property rights to their work unless otherwise stated in a contract. This protects them from any unauthorized use or reproduction of their work.

- Limited Liability: As mentioned earlier, forming a business entity can limit personal liability for freelancers if their business faces legal issues.

- Non-Disclosure Agreements: Freelancers can use non-disclosure agreements (NDAs) to protect their clients’ confidential information from being shared with third parties.

It is important for freelancers to be aware of these legal protections and utilize them in their work to ensure fair treatment and protection of their rights.

Learn why legal protection for online businesses is a must!

Overall, understanding the legal obligations and protections available to freelancers is crucial for maintaining a successful and ethical business.

What rights do I have as a freelancer?

As a freelancer, you have certain rights that are protected by law such as:

- The Right to Fair Payment: Freelancers have the right to be paid for their work in a timely and fair manner, as outlined in their contract or agreement.

- The Right to Work Without Discrimination: Freelancers cannot be discriminated against based on factors such as race, gender, age, religion, or disability.

- The Right to Negotiate Contracts: As an independent contractor, freelancers have the right to negotiate the terms of their contracts with clients.

- The Right to Intellectual Property: Freelancers own the intellectual property rights to their work and can control how it is used or reproduced.

- The Right to Privacy: Freelancers have the right to privacy and can control how their personal information is used or shared by clients.

Do freelancers get sued?

Yes, I know many freelancers get sued if they fail to fulfill their legal obligations or if a dispute arises with a client.

Common reasons for lawsuits against freelancers include having NO contract, breach of contract, copyright infringement, and negligence.

Freelancers need to be aware of potential risks and take necessary precautions to avoid legal issues in their work.

Make sure to always use a freelance contract to protect yourself.

Final Thoughts on Legal Issues for Freelancers

Freelancing offers numerous benefits, but it also comes with legal responsibilities that can’t be ignored.

Understanding legal factors helps creative freelancers protect their work and business relationships.

By understanding and avoiding these seven legal pitfalls, you can protect your business, build strong client relationships, and ensure long-term success.

For instance, service agreements and contracts drafted correctly ensure that both parties have clear expectations, which minimizes the chances of disputes and secures fair compensation.

In addition, a freelancer protects the brand reputation by managing client data responsibly and including confidentiality clauses in the contract.

Another area a freelancer should check is their use of copyrighted materials without permission. Even unintentional copyright infringement can damage a freelancer’s professional reputation and result in expensive legal battles.

Remember, contracts, intellectual property, tax compliance, payment terms, confidentiality, client relationships, and industry regulations are all areas that require careful attention.

Stay informed, seek professional advice when needed, and always prioritize legal compliance in your freelancing career.

Start with our VIP legal bundle or Freelance contract bundle here.

For personalized legal advice tailored to your freelancing business, consider booking a consultation with a lawyer like me.

Taking proactive steps today can save you from legal headaches tomorrow and help you focus on what you do best—creating amazing work for your clients.

RELATED POSTS TO LEGAL ISSUES FOR FREELANCERS

In addition to learning about legal requirements for freelancers, you should join my Facebook group here to connect with me and other entrepreneurs.

This blog offers many legal tips for entrepreneurs here.

Check out more helpful blog posts next:

15 Website Legal Requirements You Must Know

Avoid Legal Issues With This Media Release Agreement Template

Why You Need a Podcast Guest Release Form (Template Inside)

23 Legal Tips for Small Business Owners From a Lawyer

Lawyer’s Guide on How to File a BOI for LLC Correctly

15 Secrets of Best Accounting Practices for Small Business

How to License Content Correctly and What Contract You’ll Need

What’s an AI Disclaimer and Why You Need it (plus template)

Top 17 Social Media Marketing Mistakes to Avoid in Business

Single Member LLC vs Multi-Member LLC: Complete Guide

25 Tips of Financial Advice for Entrepreneurs as a Guide

VISIT THIS FREEBIES PAGE TO GET 5 AWESOME FREE BUSINESS, BLOGGING AND LEGAL TIPS!

Below are some more helpful blog posts, legal tips, tools, and resources that you should check out next:

- Beautiful Pinterest templates to increase traffic to your blog!

- What’s an LLC and when to form one?

- How to Legally Protect Your Book (with Proper Copyright Notice and Disclaimer Examples)

- AI writing tool to write blog posts 10x faster, create social media content, videos, and any kind of content to save time in business

- This SEO tool makes sure your blog posts rank on the first page of Google!

- Manage your accounting effortlessly with this amazing tool.

MORE TOOLS TO GROW YOUR ONLINE BUSINESS

- TubeBuddy to grow your YouTube channel, and this is another great tool for YouTube SEO.

- Free SEO Masterclass to learn how to optimize your blog posts for SEO to rank on Google. You can also buy this awesome bundle of ebooks instead if you prefer ebooks over video training.

- Best accounting software to manage profit and loss and more!

- Best payroll service (super affordable, too)

- A great all-in-one business platform for hosting your course, email communications, sales pages, and more!

- This paraphrasing tool to create original work for the client

- A professional theme for your website

- Millionaire blogger’s secrets here and tons of valuable resources.

- How to start your blogging business and make money online

- How to make money from affiliate marketing

- The Best Freelance Writing Contract Template (for writers and clients)

- Guest Blogger Agreement to publish guest posts on your website legally and avoid any copyright infringement, Media release agreement to be able to use other people’s photos, videos, audio, and any other content legally, Privacy policy on your website to ensure your blog’s legal compliance, Disclaimer to limit your legal liability, Terms and Conditions to set your blog rules and regulations! Get all of these templates at a discounted rate in one of my best-selling VIP legal bundle here.