Do you know the must-have documents needed to sell a business?

Maybe you are looking to sell your business and want to make sure you have all the correct paperwork and understand the process.

Selling a business isn’t just about determining a price and finding potential buyers.

It’s a complicated process that requires a variety of documents and a different skill set, and there are often emotions tied into it.

You worked hard to start and grow your business; choosing to sell can bring on a variety of emotions and a lengthy to-do list as well.

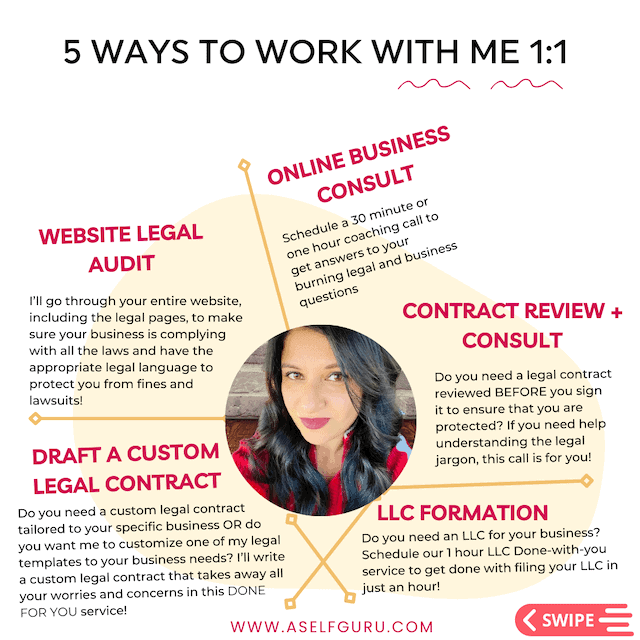

As a business lawyer, I will cover the 15 essential documents needed to sell a business and their role, as well as tips and legal templates to make the process easy and profitable.

This is not legal advice but consider this post as your business checklist and comprehensive guide.

We’re going to take this complicated business transaction of selling a business and help you understand all the paperwork.

Table of Contents

Legal Documents and Financial Statements Needed to Sell a Business

During the process of selling your business, you and potential buyers will get to know each other.

You both will go through a set of legal documents and financial statements to understand the business’s growth potential.

Prospective buyers will run through the due diligence process to make sure everything is as it seems.

Sellers do the same to get a fair price, finalize the sale, and transfer the business to the new owner.

Whether it’s a brick-and-mortar business or completely online, you need the proper documentation to show the buyer everything is legit and that you’re prepared to sell.

It’s easy to get overwhelmed by all the paperwork.

Just remember that in case the sale doesn’t go through, the documents help protect:

- You

- Your financial interests,

- Your intellectual property and content license

- your business

The paperwork also protects the potential buyer’s interests as well.

Having the right paperwork not only facilitates a smooth transaction but also builds trust with potential buyers.

Proper documentation provides a transparent view of your business’s operations and finances, which can help attract serious investors and avoid legal issues down the road.

Related Post: 23 Top Legal Documents Needed to Start a Business

What Documentation Do I Need to Sell My Business?

Let’s dive into the documents needed to sell your business legally, have a smooth transition, and make a profit.

Confidentiality Agreement (NDA) Template

The Non-disclosure Agreement, also known as a Confidentiality Agreement, is a legal contract between two or more people or parties.

This agreement keeps the information they share with each other confidential.

This legal document protects proprietary and sensitive information and gives you legal recourse if someone tries to steal anything related to this in your business.

An NDA is the most important legal document to use when selling your business.

It’s especially critical when it comes to the Confidential Information Memorandum (CIM), where you disclose different aspects of the business in a summary, including:

- Your business plan

- A business description and type of business

- Financials

- Operations

- Strategic marketing positioning

- Customer base

It also protects the buyer’s critical financial information when pre-qualifying them to make sure they have the funds to purchase your business.

The CIM allows potential buyers to understand the possible risks and things that drive value for the business so they can create informed offers.

There may be a customer interaction management software a company uses so this contract allows you to get access to that insider data as well.

This NDA template also comes at a discount in our best-selling VIP legal bundle here.

Tax Returns and Financial Statements

Not surprisingly, during the sales process, you must provide various financial documents, income statements, your company’s assets, and other financial information, including:

- A Personal Financial State Form

- A Note of Seller Financing

- A Profit and Loss Statement (Income Statement) – Provides a clear picture of the business’s profitability.

- Tax returns for the last few years

- A finance trends review

- A balance sheet – Lists liabilities, owner’s equity, and business assets

- An inventory list

- Documentation of the seller’s discretionary earnings and cash flow statement – Represents how well your business manages cash.

- Accounts receivable and payable – A detailed financial record that illustrates the business’s credit management and cash flow cycle practices. We will discuss this in more detail below.

- Valuation reports – Justify your pricing and use a variety of valuation records like discounted cash flow, earnings multiplier, etc.

- A description of intangible assets

- Other financial statements

This information is crucial for illustrating the financial health of your business and proving that it’s in good standing.

Both are important for securing a lucrative deal for both parties.

It’s a good idea to get a financial advisor to help you compile and organize the paperwork needed to ensure a successful transaction.

- Oh, one more thing, is your website breaking this law? Prevent costly ADA lawsuits with this bundle.

Employment Agreements

Employment agreements are essential, especially when selling small businesses that rely on important employees.

These documents define their terms of employment, roles, and responsibilities.

This documentation is something else that can increase the appeal and value of your business.

These documents could also include any independent or freelance contracts you have with any independent contractors. If you’re not using a freelance contract, you are opening yourself up to lawsuits.

I have personally seen those effects in my own family when a freelancer sued my dad for $90,000.

I discuss this costly legal mistake in this video.

Due Diligence Documents

The due diligence phase of any business sale is vital, and providing proper documentation and verifying that it is accurate can make or break your sale.

Answering questions and showing the following information is key:

- Any contracts between customers, partners, or suppliers

- Any licenses like a business license or other industry or professional licenses

- Property or equipment leases

- Employment contracts between management and key staff

- Intellectual property, including any copyrights or relevant patents and trademarks

During this phase of the sale and collection of documents, a sales readiness team is handy to help gather, organize, and prepare the paperwork for review.

This team can make sure that your business is ready for examination.

And it’s during this process that they can correct any problems that could endanger any part of the sale later on.

Letter of Intent (LOI)

A Letter of Intent illustrates a serious commitment from a buyer and explains the preliminary sale terms.

This legal documentation precedes the final purchase agreement.

Purchase Agreement

After everyone signs the letter of intent, attorneys on both sides start working on the purchase agreement, which is a legally binding contract.

These signatures mark the final step in the selling process before the transfer and after completing all the paperwork, third-party valuation, and due diligence.

This is where the important bill of sale comes into play as part of the closing sale paperwork to transfer ownership of the company to the purchaser.

The Bill of Sale should include important information such as:

- The names and contact information of the seller and buyer

- An asset list of things included in the sale (customer lists, equipment, inventory, etc.)

- Sales price

- The date of sale and closing date

- Representations and warranties given by the seller

- Conditions of the sale

Website Sale Agreement

In today’s digital world, you likely have a website attached to the business entity you’re selling.

This website sale agreement template for buyers and sellers is a comprehensive document.

It details the essential clauses you need to sell your website or flip websites for profit.

It protects you and the potential buyer from any potential legal issues.

The website sale agreement provides a legal recourse if one of you breaks the contract.

It also covers you if someone does something illegal or that is not in the best interest of either party.

See how my customer used this Website Sale Agreement to sell her online business:

If you need this contract, get it here and you can also schedule a call with me to discuss this contract or review and advise on any other legal document during the sale process.

Accounts Receivable and Payable

Lists of accounts receivable and payable provide insight into the business’s cash flow and financial obligations.

Buyers will examine these lists to understand credit risk and debt recovery expectations.

Accounts receivable indicate future revenue, while accounts payable represent obligations that need to be settled.

A balanced and accurate representation of both is crucial for demonstrating the business’s financial health.

These documents, when meticulously prepared, can project an image of efficiency and reliability, appealing to potential buyers.

Operating Agreements and Bylaws

For businesses structured as partnerships or corporations, operating agreements, and bylaws are critical documents.

If the business is operating as a sole proprietor instead of an LLC, the owner should have the authority to transfer the sale.

If there’s an operating agreement in place, it should outline the governance of the company, including decision-making processes and ownership rights.

Buyers will want to see these to understand how the business is run and their potential role within it post-sale.

These documents clarify who the stakeholders are, what their respective roles include, payment schedules, if any, and how decisions are made within the company.

For a buyer, having clear governance structures in place is reassuring, as it shows the business is managed effectively and has established protocols for handling conflicts or changes in leadership.

And here’s an LLC Operating Agreement template for your new LLC.

Lease Agreements

You may also need to provide a copy of your lease agreement if you rent the business premises.

This document will outline the terms and conditions of your lease, including any restrictions or limitations that may affect the sale of the business.

It is important to review this agreement and ensure that it allows for the transfer of ownership to a new owner.

- If you’d like to rank your blog posts on the FIRST page of Google then I highly recommend using this amazing SEO tool from day one! Learn more by watching the video here.

Franchise agreements

If your business operates as a franchise, you will need to provide a copy of your franchise agreement.

This document outlines the terms and conditions set by the franchisor, including any fees or obligations that must be fulfilled upon selling the business.

It is essential to understand these requirements before proceeding with a sale as a small business owner.

- Join over 5 million secure WordPress site owners using Wordfence Free. Block attacks with the basic tools you need to keep your site safe.

Supplier contracts, service contracts, and equipment leases

As part of selling your business, you may need to provide copies of supplier contracts, service contracts, and equipment leases.

These documents outline the terms and conditions for providing goods or services to your business and may have a significant impact on its operations.

It is important to review these agreements with a lawyer and ensure they can be transferred to a new owner without any issues.

Customer Lists

This can make a business more attractive to buyers, and a healthy customer list can add value and support a higher asking price.

Inventory List

For businesses dealing in tangible goods, a comprehensive inventory list is crucial.

This document should include details such as inventory levels, locations, and valuation.

Buyers need this information to assess the value of the business and plan for continuity of operations.

A well-maintained inventory list not only showcases effective business management but also aids in valuing your business accurately.

This transparency helps the buyer make informed financial decisions and assures them of a smooth transition, knowing they have a clear picture of the assets they are acquiring.

FYI: Is it legal to use AI in business? See this video to learn more.

Real estate records and any landlord-tenant information

This is important if your business owns its building or property.

Providing records such as deeds, mortgages, and property tax information can give potential buyers a better understanding of the business’s assets and financial stability.

Marketing plans and Advertising materials

These documents can showcase the business’s marketing strategies and their effectiveness in attracting customers.

They can also provide insight into the target audience and the business’s brand image.

Develop an Exit Strategy

As leaving or selling a business can be overwhelming and emotional, it’s essential to develop an exit strategy.

Any exit strategy should support your expectations and goals and provide maximum value for you and your business.

As part of your exit strategy, you will want to do things like:

- Consider your options for exiting

- Prepare your finances

- Choose new leadership for the transition period until the new owner takes over leadership.

- Talk to any investors

- Inform your customers and employees

Consulting with the right professionals, a lawyer, and others can make this process much easier and less overwhelming.

FAQs for Documents Needed to Sell a Business

Below are answers to common questions about documents needed to sell a business.

What are the steps to selling a small business?

Selling a business can seem overwhelming, but we can break it down into 8 simple steps:

- Get a business valuation to discover the value of your business.

- Get organized and prepared to sell your business: Do your due diligence and gather up all the legal documents, financial statements, and other paperwork you need. Think, what do I need to sell my business?

- Decide on a purchase price.

- List your business for sale with a business broker. Use these tips.

- Evaluate the potential buyers as they come in.

- Choose the right buyer, negotiate a deal, and accept the offer.

- Complete the closing sale paperwork and finalize the sale.

- File the necessary documents with the IRS or any other government or business entity.

Breaking it down allows you to plan for the sale of your business and make sure you have all the important documents and financial documents.

Plus, it ensures you won’t miss any important steps. A business appraiser can help with some of the process.

How do you sell ownership of a business?

In essence, you write a detailed bill of sale outlining what the buyer is receiving.

Say your business model is a single-owner LLC.

You must also make it clear that the person is purchasing just the assets of the business or 100% ownership.

Then, you must file all the required IRS forms, including Form 8822-B, to change the LLC’s responsible party.

If you need help filing a new LLC for your business, book this service here.

How do I prepare for a business sale?

Preparing to sell your business is slightly different from the actual sale process.

For one, it requires gathering the documents needed to sell a business.

I suggest using a comprehensive checklist in your project management tool to stay organized and ensure you don’t forget anything important.

But here are the 8 most important steps to prepare for a business sale:

- Determine why you are selling and your goals for the sale.

- Make sure you’re emotionally and mentally prepared to sell your business.

- Consider your customers when planning to sell your business.

- Decide on the timing of the sale.

- Organize your paperwork using this tool, tax documents, and financial records.

- Get a business valuation.

- Market your business for sale and evaluate prospective buyers as they come in.

- Decide on a buyer, prepare a sales agreement, and transfer ownership of your business. If you need contracts, grab them here or work with a lawyer like me to custom-draft your purchase agreement.

Which legal bundle is best for your online business protection? Learn more here.

Final Thoughts on Documents Needed to Sell a Business

Selling your business is a significant and often complicated process, but having the right documents can make all the difference.

Refer to this comprehensive list and save this post for future reference!

As you learned, everything from NDAs and tax returns to due diligence documents and employment contracts plays a crucial role in ensuring a smooth, successful sale.

These documents not only protect your financial and legal interests but also help build trust with potential buyers, streamline negotiations, and avoid unnecessary complications.

By staying organized and well-prepared, you’ll be in a better position to maximize the value of your business and ensure a seamless transition.

In the end, having the right paperwork in place is key to protecting what you’ve built and setting the stage for a successful sale.

Related Posts to What Documents Are Needed to Sell a Business

In addition to learning about documents needed to sell a business, you should join my Facebook group here to connect with me and other entrepreneurs.

This blog offers many legal tips for entrepreneurs here.

Check out more helpful blog posts next:

Should I Form an LLC for My Blog? (Lawyer Tips)

Lawyer’s Guide to ADA Website Compliance (WCAG Checklist)

Blog Disclosures and Disclaimers: Examples and Template You Need

11 Essential Website Legal Pages You Need (+ Templates)

Lawyer’s Guide on AI Disclaimer for Website (+Template)

Creating a Website From Scratch: 13 Essential Steps

19 Small Business Team Building Ideas to Drive Success

25 Tips of Financial Advice for Entrepreneurs as a Guide

16 DIY Legal Templates Entrepreneurs Need

VISIT THIS FREEBIES PAGE TO GET 5 AWESOME FREE BUSINESS, BLOGGING, AND LEGAL TIPS!

Below are some more helpful blog posts, legal tips, tools, and resources that you should check out next:

- Beautiful Pinterest templates to increase traffic to your blog!

- What’s an LLC and when to form one?

- How to Legally Protect Your Book (with Proper Copyright Notice and Disclaimer Examples)

- AI writing tool to write blog posts 10x faster, create social media content, videos, and any kind of content to save time in business

- This SEO tool makes sure your blog posts rank on the first page of Google!

- Manage your accounting effortlessly with this amazing tool.

MORE TOOLS TO GROW YOUR ONLINE BUSINESS

- TubeBuddy to grow your YouTube channel, and this is another great tool for YouTube SEO.

- Free SEO Masterclass to learn how to optimize your blog posts for SEO to rank on Google. You can also buy this awesome bundle of ebooks instead if you prefer ebooks over video training.

- Best accounting software to manage profit and loss and more!

- Best payroll service (super affordable too)

- A great all-in-one business platform for hosting your course, email communications, sales pages, and more!

- This paraphrasing tool to create original work for the client

- A professional theme for your website

- Millionaire blogger’s secrets here and tons of valuable resources.

- How to start your blogging business and make money online

- How to make money from affiliate marketing.

- The Best Freelance Writing Contract Template (for writers and clients)

- Guest Blogger Agreement to publish guest posts on your website legally and avoid any copyright infringement, Media release agreement to be able to use other people’s photos, videos, audio, and any other content legally, Privacy policy on your website to ensure your blog’s legal compliance, Disclaimer to limit your legal liability, Terms and Conditions to set your blog rules and regulations! Get all of these templates at a discounted rate in one of my best-selling VIP legal bundle here.