What’s the best financial advice for entrepreneurs and which one will help you achieve your business goals?

To help navigate the financial landscape as a small business owner, we’ve gathered 25 best financial planning tips from successful entrepreneurs, CEOs, founders, and other industry leaders.

From the importance of creating a budget to the necessity of separating personal and business finances, these valuable insights offer a roadmap to financial success for any entrepreneur.

So check them out below and let me know in the comments which one is your favorite financial tip!

Table of Contents

25 Most Important Financial Tips for Entrepreneurs

Create and Stick to Your Budget

One essential financial tip for entrepreneurs is to create and stick to a budget.

Think of it like a spending plan. This helps you keep track of where your money is going and how much you can afford to invest in your business.

Budgeting helps avoid overspending, reduces financial stress, and ensures you have enough money for both everyday expenses and unexpected costs.

It’s like having a roadmap for your finances, making it easier to make smart decisions and secure funding if needed.

So, start budgeting early, and it will be a key tool in your journey to entrepreneurial success.

-Bethel Sheferaw, CEO, Bethel Sheferaw

Maintain a Healthy Cash Reserve

From my personal experience, the most invaluable piece of financial advice I’d give to fellow entrepreneurs is: Always maintain a healthy cash reserve.

There were countless times when unexpected events arose or revenue streams fluctuated unexpectedly.

Having that buffer not only gave me peace of mind, but also the flexibility to seize unforeseen opportunities and navigate challenging times.

Don’t stretch yourself too thin; always be prepared for the unexpected.

-Alexander Capozzolo, CEO, SD House Guys

Adopt a Save-First, Spend-Later Approach

If you’re starting a business, here’s some simple money advice: save first, spend later.

This approach has been tried and tested, and it really works.

It’s understandable that when you’re excited about your business, you want to use all the money to make it grow.

However, it’s crucial to keep some money aside. Consider it as a safety net for times when your business doesn’t make a lot or unexpected problems arise. This way, you won’t stress too much about money.

By saving regularly and not spending everything you make, your business becomes strong and ready for any surprises. It’s a smart strategy that can keep your business stable, even in the unpredictable world of entrepreneurship.

-Johannes Larsson, Founder and CEO, JohannesLarsson.com

Consider Outsourcing to Save Costs

Consider outsourcing tasks when it makes sense.

Think about getting outside help instead of hiring full-time workers.

Often, entrepreneurs think that just hiring full-time specialists will solve everything.

But they forget about the real costs linked to a full-time employee. Many only think about the basic pay, overlooking added costs like health benefits, workspace, tools, and retirement benefits.

Getting help from outside, or outsourcing, can save these added costs.

It might take a bit to get used to, but in the long run, it can save both money and resources.

A good idea is to outsource projects to online freelancers now, which, in my opinion, is really cost-effective without compromising quality.

You can better handle your budget and business finances if you outsource.

Plus, you can save more money in the long run. Just make sure that you are outsourcing the right tasks to the right people or company.

-Jonathan Merry, Founder, Moneyzine

Separate Personal and Business Finances

Do not mix personal finances and business financial accounts.

Keeping separate bank accounts and records can help you manage your business finances in a more organized fashion.

Additionally, separating business from personal helps protect you if something happens to your business.

When you’re just starting out, it may seem easier to handle your business finances through your personal accounts, but you’ll pay for that legal mistake.

–Michelle Robbins, Licensed Insurance Agent, Clearsurance.com

Your business is a separate entity from you, and it should have its own bank account, credit cards, and financial records.

Trust me, mixing your personal and business finances can lead to a tangled mess that’s hard to untangle come tax time.

Plus, when you keep things separate, you get a clearer picture of your business’s financial health and it’s easier to track income, expenses, and profits.

But the real magic happens when you protect your personal finances and assets (like your home and savings) from any potential business liabilities or debts.

That’s a financial safety net every entrepreneur should have.

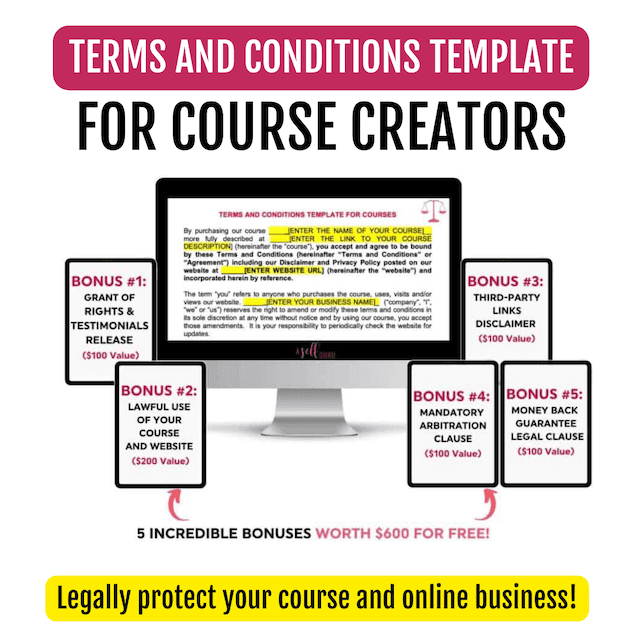

And you can easily keep your personal and business finances separate when you form an LLC for your business.

–Latoya Murray, CEO, LaToya Rachelle

Leverage Strategic Debt for Growth

We should view strategic debt as a financial instrument rather than a burden. Debt is traditionally viewed as something to be avoided. However, when tackled wisely, it can be a catalyst for growth.

Entrepreneurs frequently strive for debt-free status, but my unconventional advice is to use low-interest business loans or credit lines to speed business growth.

Entrepreneurs can invest in increasing their operations, marketing, or product development by getting cash at favorable rates, resulting in rapid growth and higher profitability.

The idea here is to wisely use borrowed funds, investing in sectors that yield a clear return on investment. It’s all about taking measured risks. As a result, the company grows faster than if it relied simply on organic sales growth.

However, it’s essential to approach this strategy cautiously, with a clear plan for repayment and a focus on ROI. Ensure that the debt taken on serves as a valuable asset, not a liability.

-Percy Grunwald, Co-Founder, Compare Banks

Diversify Your Revenue Streams

From the countless lessons I’ve gleaned as an entrepreneur, one financial insight remains paramount: Diversify revenue streams; don’t rely on a single source.

Early in my journey, I leaned heavily on one major client, and when they pulled out, my business took a major hit.

Diversifying since then has not only stabilized my income but also reduced risks associated with market volatility. Multiple revenue sources can cushion your business against unforeseeable setbacks and provide sustainability in tumultuous times. Don’t put all your eggs in one basket.

-Shoaib Mughal, CEO, Marketix

Related Video: Talking about different sources of income, here are 5 secret ways I made $78,000 a month blogging!

Have a Business Plan

Being an entrepreneur can be a daunting task. With the excitement of creating something from scratch, comes a lot of uncertainty.

This is where having a business plan comes into play.

A business plan serves as a roadmap for entrepreneurs, helping them navigate through the challenging terrain of starting and running a business.

Having a business plan helps entrepreneurs to clearly define their goals.

Without clear goals, entrepreneurs can quickly get sidetracked and lose focus.

A business plan forces entrepreneurs to think critically about what they want to achieve and how they will go about achieving it.

This clarity helps them make informed decisions that are in line with their long-term objectives.

-Charlie Daily, CEO, The Parent Gadget

Factor Inflation into Financial Goals

My advice is to always factor in inflation when making long-term financial goals.

This is a hard lesson learned in the aftermath of COVID. Adjusting your financial goals and including emergency funds will help you prepare for any economic fluctuation, and this will help you protect your assets.

On that note, don’t put all your eggs in one basket. It is important to diversify your assets to prepare for economic downturns. In case a niche market is terribly affected, you can rely on another source of income.

-Siva Mahesh, Founder and Finance Expert, Dreamshala

Invest in the Arts for Diversification

Financial success as an entrepreneur requires careful budgeting and wise investment. An uncommon advice to entrepreneurs is to invest in the arts.

Investing in art can prove lucrative if wise choices are made about which pieces to purchase, but even if the market isn’t bullish on a certain item, owning artwork provides a source of inspiration and offers tax write-offs should one decide to resell it.

It also adds tangible value and offers potential returns in areas not usually found in traditional stocks and bonds.

-Julia Kelly, Managing Partner, Rigits

Invest in the Growth of Your Business

One of the important steps of building a thriving business is investing in your growth and learning.

My advice is to not be afraid to invest in your business.

Not just time but also money.

Any size of monetary investment counts towards the growth of your business.

And to have patience. Any business takes time, hard work, resilience, and definitely research to see results.

A plant that is fully grown is because someone planted a small seed and it was well taken care of through time. The same concept applies to large and small businesses.

-Ana Melendez, CEO, The Work at Home Blogger

Related Blog Posts and Tool to Help Grow Your Business:

- Use this SEO tool to rank your blog posts on the FIRST page of Google (it is awesome to generate free traffic to your website)

- Free SEO masterclass to learn if you are clueless about SEO.

- Struggling with creating content for your business? Use this AI tool to create any kind of content in minutes!

- Outrank your competition with this tool

- Did you know you can generate loads of traffic to your business for free from Pinterest? Try these Pinterest strategies

- 6 best Pinterest courses to increase traffic to your website

- Top 40 Blogging tools to make six figures online

Build Passive Income Sources

The best piece of advice for a financial future I have for all entrepreneurs is to prioritize building passive income, just as much as active income.

Building a foundation for passive income is going to protect your business, and even your dreams, because it is an investment in both your business and yourself.

When you work to build passive income from day one, you have already saved your future self hours, if not days or even years, of hard work.

Passive income could be in terms of creating digital products of your own that you create once but can sell over and over again. Then use these sophisticated email marketing funnels to sell it automatically.

If you’re thinking ‘I wish I had the passive income to support my family and my business so I could finally take that break, spend more time with loved ones, or even retire early’, then now is the second best time to start working on your financial stability.

-Nicole Nicolet, CEO, Let’s Make Life Great

Don’t Quit Regular Jobs Prematurely

My financial advice to entrepreneurs is not to quit their regular jobs until the business is well-established with a profit that can accommodate a decent salary.

Another option is for your spouse to have a good enough job to finance all your household expenses so that you can focus on your business.

Either way, don’t depend on your business to pay any of your bills for five to seven years. You need another regular, substantial source of income so you aren’t under the stress of bills while you build your business.

-Bruce Tasios, CEO, Tasios Orthodontics

Use Credit Cards Wisely

Use those credit cards the same as cash. Put every expense you can on your credit card, then pay it off immediately (even daily) to avoid racking up a balance.

This will provide better fraud protection, earn credit card rewards, and help build your credit.

-Christopher Olson, CFO, Surfside Services

Track All Business Expenses

Tracking all business expenses helps stay organized.

This is important for identifying wasteful spending, prioritizing essential expenses, and alleviating stress.

Expense-tracking software and apps are used to manage business expenses.

They provide real-time visibility into business expenses and reduce expense-related errors. Most importantly, business and personal expenses are kept separate.

-Logan Nguyen, Co-Founder, NCHC.org

Prioritize Debt Elimination

Entrepreneurs should prioritize removing all their existing personal and business debt as soon as possible to ensure future success. This is because debt inadvertently causes financial stress for the business owner.

If you have a lot of debt, it will divert your time and energy towards paying off the dues instead of focusing on innovation and business growth.

Such a financial situation will also strain your mental health; you won’t have peace of mind worrying about the situation, which will further add to your stress.

Debt also carries interest payments, which can significantly drain a company’s cash flow. In the worst-case scenario, the situation can lead to bankruptcy. By paying off debts, entrepreneurs free up capital for investment in their ventures, expansion, or emergency needs. Having a debt-free status will also enhance your creditworthiness. You can secure financing at favorable terms when necessary for business growth and ensure long-term success.

-Loretta Kilday, DebtCC Spokesperson, Debt Consolidation Care

Adopt the 3:1 CLV to CAC Ratio

A big mistake I see my mentees make is not investing enough in their business.

They are so scared of the business going south that they take too much money out of their business to invest in stocks, bonds, and other “stable” investments.

However, this is a big problem because if you don’t invest back into your business, you effectively cede market share to your competitors.

This is why I recommend using the 3:1 CLV (Customer Lifetime Value) to CAC (Customer Acquisition Cost) ratio, which says that you should invest one-third of your CLV into acquiring a new customer.

This ensures you aren’t ceding market share while being able to diversify your investments.

-Scott Lieberman, Owner, Touchdown Money

Price for Profit, Not Undercutting

One of the most common mistakes I see entrepreneurs make is charging less than their competitors.

Then, after a few months, they realize they’ve not been making a profit. Always price for a profit.

One of the best practices is pricing your items well will not only help you make a profit but also trounce your competition without diminishing the perceived value of your brand.

Charging what your competition charges is suggested. Most importantly, expect your running costs to be higher than expected.

-Young Pham, Founder and Project Manager, Biz Report

Cultivate a Strong Banking Relationship

I understand the value of a strong banking relationship from my experience as a small business owner. I wish I’d developed that connection earlier.

Many entrepreneurs start their journey with lines of credit, loans, and a savings account at multiple institutions.

This approach might work for the average consumer, who is looking for points or rewards, but as a business owner, it’s far better to keep your finances at a single bank or credit union.

Keeping your finances in one place not only simplifies your bookkeeping, but it also gives you a chance to build a long-term relationship. This relationship will be beneficial in the future when you’re looking for someone you trust to help implement a growth strategy for your expanding business.

-Rob Reeves, CEO and President, Redfish Technology

Learn to Spot Scams

One critical financial tip I’d offer is to become adept at spotting scams.

In the world of business, especially when you’re starting out, there are plenty of opportunities that might seem too good to be true. Learning how to recognize and steer clear of scams can save you from financial disaster and protect your hard-earned money.

Scammers often prey on the eager and ambitious, so staying vigilant and doing thorough due diligence before investing in any opportunity is crucial.

Make sure to always do thorough research, ask for references, and be cautious of anything that promises overnight success or asks for a hefty upfront investment without a clear and legitimate business plan.

-Daniel Willmott, Founder, Shortformvideo.co

Establish an Emergency Fund

I advise entrepreneurs to maintain a substantial financial buffer, or emergency fund, as an essential piece of financial advice.

Frequently, entrepreneurship is accompanied by financial insecurity and unforeseen obstacles. A financial safety net provides ease of mind and stability.

A reserve fund can help cover unanticipated expenses, bridge financial voids during lean times, and prevent personal financial strain from affecting the business. In addition, it enables business owners to make strategic decisions based on long-term objectives rather than short-term financial pressures.

By prioritizing an emergency fund, business owners can navigate the inevitable ups and downs of business ownership with greater confidence and resiliency, which is crucial for long-term success and financial security.

-John Truong, Managing Director and Attorney, Alliance Compensation & Litigation Lawyers

Regular Review Your Business Account (and Numbers)

Take the time to look at your numbers. Granted this has always been my weakest point.

But when I took a vacation one time without looking at my accounts, I got back to a business that had negative finances, and nothing to pay myself AND my staff!

It’s a mistake that I am sure will never happen again.

So now I make it a point to look at my numbers: I track my expenses and cash flow on a daily and weekly basis; and track my sales revenues, profit, and receivables on a monthly basis.

It helps me see whether I’m on track for expected expenses, if I can invest on certain aspects of the business, and if I am indeed making a more-than-decent living out of it!

-Camyl Besinga, CEO, Gal at Home Design Studio

FAQ on Financial Advice for Entrepreneurs

Below are answers to some questions that come up regarding financial advice for entrepreneurs:

What is the best advice for entrepreneurs?

My best advice for young entrepreneurs is to always believe in yourself and your vision.

It can be easy to get discouraged or doubt yourself when starting a new business, but having confidence in yourself and your ideas is crucial for success.

Another important piece of advice is to constantly learn and adapt.

The business world is constantly changing, so it’s important to stay informed and open-minded. Attend workshops, read books and articles, network with other entrepreneurs – there are endless opportunities for learning and growth.

Networking is another key aspect of being an entrepreneur.

Building relationships with other professionals can lead to valuable connections, partnerships, and support. Don’t be afraid to reach out to others in your industry or attend networking events – you never know who you might meet or what opportunities may arise.

In addition, I highly recommend surrounding yourself with a strong support system.

Starting and running a business can be emotionally and mentally taxing, so having family, friends, or mentors who understand and support your goals can make all the difference. They can provide encouragement, advice, and sometimes even practical help.

Lastly, remember to take care of yourself both physically and mentally.

As an entrepreneur, it’s easy to get caught up in the hustle and neglect self-care.

But maintaining a healthy work-life balance is crucial for long-term success. Make time for hobbies, exercise regularly, and prioritize sleep – taking care of yourself will ultimately benefit your business as well.

Always remember that you are the most valuable asset to your business. So take care of yourself first!

How an entrepreneurs manage their finances?

Check out all the tips above from personal financial planning to creating a budget to separating your personal and business finances with an LLC and more!

What are the financial skills required for an entrepreneur?

As an entrepreneur, having strong financial skills is essential for managing your business successfully.

Some important financial skills to develop include:

- Budgeting and forecasting: Being able to create and stick to a budget is crucial for managing cash flow and planning for the future. Forecasting involves using data and trends to make educated predictions about the future financial performance of your business.

- Bookkeeping: Keeping accurate records of all income, expenses, assets, and liabilities is essential for understanding the financial health of your business. Familiarize yourself with basic bookkeeping principles or consider hiring a professional accountant.

- Financial management: This includes analyzing financial reports, identifying areas for improvement or growth, and making strategic decisions based on financial data.

- Understanding taxes: As a business owner, you will be responsible for filing taxes and keeping up with tax laws and regulations. It’s important to have a general understanding of the tax requirements for your business and consult with a tax professional if needed.

By developing these financial skills, you can effectively manage your finances as an entrepreneur and make informed decisions that will contribute to the success of your businesses.

What is financial plan in entrepreneurship?

A financial plan in entrepreneurship refers to a strategic document that outlines the financial goals, strategies, and action plans of a business.

It includes detailed projections and analysis of the company’s finances, such as projected income and expenses, cash flow forecasts, break-even analysis, and return on investment calculations.

A well-developed financial plan is crucial for entrepreneurs as it helps them make informed decisions regarding budgeting, investments, and growth opportunities. It also serves as a roadmap for managing finances and achieving long-term success.

Final Thoughts- Financial Advice for Entrepreneurs

In conclusion, starting a business requires much more than just a great idea. A number of entrepreneurs fail because of the financial decisions they make in their own business.

Follow these tips to create a nine-figure mindset.

As new entrepreneurs, it is essential to have a clear understanding of the financial aspect of your venture.

Most important thing is to keep track of expenses, manage cash flow carefully, and seek professional advice from a financial advisor when needed.

By following the financial tips above and being diligent with managing your finances, you can set yourself up for success as an entrepreneur.

Remember to stay focused, be adaptable, and always have a backup plan. With determination and a comprehensive financial plan, you can turn your dream into a profitable reality.

RELATED BLOG POSTS ON FINANCIAL ADVICE FOR ENTREPRENEURS

In addition to the financial advice for entrepreneurs we discussed above, join our Facebook group here for more inspirational content. You should check out the following blog posts next:

- 27 Best Crystals for Business for Success and Money

- 7 Most Powerful habits of self-made millionaires.

- 25 Best Christmas in July Gift Ideas (#5 is the BEST)

- 63 Best Gifts for Entrepreneurs That They Will Love!

- 27 BAD Christmas Gifts that Nobody Wants

- 21 Best Secret Santa Gift Basket Ideas (#7 is everyone’s favorite!)

- 18 Questions to Ask a Lawyer BEFORE Starting a Business

- Best blogging books to make six-figures in a year (#5 is the best!)

- How to Write Your Own Book in 30 days (21 Expert Tips!)

- Are you Blogging Legally? 15 Essential Legal Tips!

- Email Marketing vs Social Media – Which one is better?

- What is the true meaning of Boss Babe?

- How to Pitch a Podcast (17 Best tips with Templates)

VISIT THIS FREEBIES PAGE TO GET 5 AWESOME FREE BUSINESS, BLOGGING AND LEGAL TIPS!

Below are some more helpful blog posts, legal tips, tools and resources that you should check out next:

- Outrank your competition and enhance your content creation

- 13 Worst Website Mistakes to Avoid

- 15 Expensive Legal Mistakes Entrepreneurs Make (and How to Avoid them)

- Beautiful Pinterest templates to increase traffic to your blog!

- What’s an LLC and when to form one?

- How to Legally Protect Your Book (with Proper Copyright Notice and Disclaimer Examples)

- Tax Saving Forms

- CPA Solution Membership to get all your tax and accounting questions answered!

- Get The Simple SORT Handbook: The New Entrepreneur’s Roadmap to Setup, Operate, Record and Tax Slay a Successful Business

- AI writing tool to write blog posts 10x faster, create social media content, videos, and any kind of content to save time in business

- This SEO tool to make sure your blog posts rank on the first page of Google

MORE TOOLS TO GROW YOUR ONLINE BUSINESS

-

- Free SEO Masterclass to learn how to optimize your blog posts for SEO to rank on Google. You can also buy this awesome bundle of ebooks instead if you prefer ebooks over video training.

- Best accounting software to manage profit and loss and more!

- Best payroll service (super affordable too)

- A great all-in-one business platform for hosting your course, email communications, sales pages, and more!

- This Paraphrasing tool to create original work for the client

- A professional theme for your website

- Millionaire blogger’s secrets here and tons of valuable resources.

- How to start your blogging business and make money online

- How to make money from affiliate marketing

- The Best Freelance Writing Contract Template (for writers and clients)

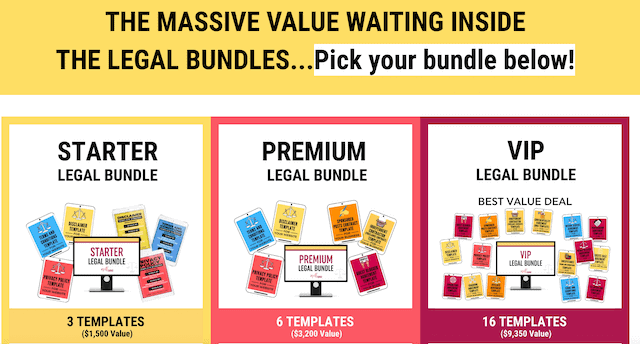

- Guest Blogger Agreement to publish guest posts on your website legally and avoid any copyright infringement, Media release agreement to be able to use other people’s photos, videos, audio, and any other content legally, Privacy policy on your website to ensure your blog’s legal compliance, Disclaimer to limit your legal liability, Terms and Conditions to set your blog rules and regulations! Get all of these templates at a discounted rate in one of my best-selling VIP legal bundle here.