Are you looking for the best books on budgeting?

Budgeting is an essential aspect of our finances that allows us to manage our money effectively, save for the future, and achieve financial stability.

With so many different aspects to consider when creating a budget, it can sometimes feel overwhelming and challenging to know where to start.

However, one valuable resource that can provide in-depth knowledge and diverse perspectives on budgeting is books.

Diving into the world of financial mastery, we’ve compiled 15 expert recommendations on the best books for budgeting from financial planners to CEOs.

From the holistic approach of “You Need a Budget” by Jesse Mecham to the timeless advice in “The Wealthy Barber” by David Chilton, these professionals explain why these reads are essential for anyone looking to take control of their finances.

I’ll also provide you with tips for choosing the right books to fit your financial and budget goals.

Table of Contents

Why Read Books on Budgeting?

While there are plenty of articles and blog posts available online offering budgeting advice, books offer a more comprehensive and detailed approach.

In a book, authors have the space to delve deeper into their strategies and theories, providing readers with a better understanding of complex financial concepts.

Additionally, each budget book may have a unique perspective or method for managing money, giving you a variety of options to choose from.

Investing in a book on budgeting can also be cost-saving in the long run.

Instead of paying for expensive financial courses or services, a budgeting book can offer similar information at a fraction of the cost.

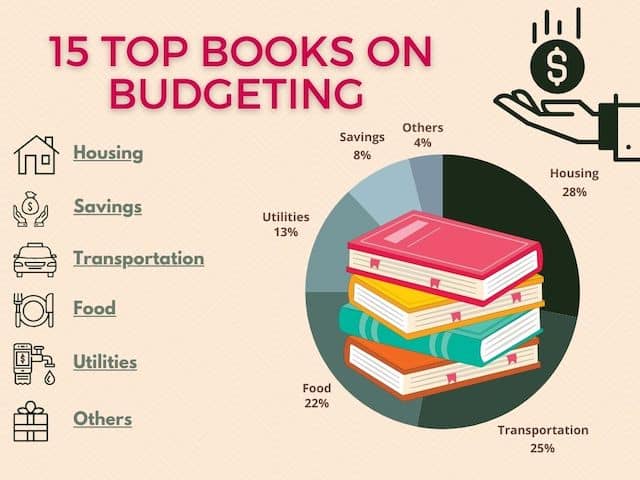

15 Top Books on Budgeting for Financial Independence

Check out these best budgeting books as a comprehensive guide and select the ones that resonate with you.

Rich Dad, Poor Dad by Robert Kiyosaki and Sharon Lechter

This is my favorite book. When it comes to money habits, Robert Kiyosaki shares valuable insights from his own personal experiences growing up.

He also delves into the mindset and behaviors of the wealthy, providing a unique perspective on building wealth.

This book delves into the mindset behind financial success, highlighting the importance of financial education and building assets instead of relying on a traditional 9-5 job.

It also discusses the concept of creating multiple streams of income for long-term financial stability.

You Need a Budget By Jesse Mecham

When it comes to personal finance and budgeting, I highly recommend the book “You Need A Budget” by Jesse Mecham.

This book provides a comprehensive, step-by-step guide to zero-based budgeting and having a money management system.

Unlike some other budgeting books that focus just on cutting expenses, “You Need A Budget” takes a more holistic approach.

It teaches you how to prioritize spending, account for every dollar, and break the paycheck-to-paycheck cycle. The four main rules of the YNAB method have been truly life-changing for me and many others.

What I appreciate most about this book is that it goes beyond the numbers to address the psychological and behavioral aspects of budgeting.

The author understands that budgets fail when they feel restrictive and don’t align with your values.

With compassion and humor, the book helps you change your money mindset.

If you’re looking to gain control of your finances and build lasting budgeting habits, “You Need A Budget” is an excellent choice.

The interactive exercises and practical approach have helped thousands find financial freedom. It’s an essential guide that I can’t recommend enough.

–Charles Veprek, Director of Business Development, IT Asset Management Group (ITAMG

Your Money or Your Life by Vicki Robin

One of the best books on budgeting I recommend is “Your Money or Your Life” by Vicki Robin and Joe Dominguez.

This choice is informed by my background in handling financial planning and budgeting across various levels, including teaching, consulting, and actual implementation in startups during my tenure as a CPA at Pace & Associates.

I’ve found that Robin and Dominguez provide a proven path and transformative approach to managing personal finances.

This can easily be translated into prudent business budgeting practices for a small business owner.

Their concept of aligning your spending with your values offers a powerful framework that I’ve successfully applied when advising startups in creating budgets that reflect not only financial goals but also the broader objectives of their business.

Through my years of experience, particularly in facilitating startups to implement scalable budgeting systems, this book’s philosophy helps entrepreneurs to more effectively forecast future financial strategies, make informed spending decisions, and maintain cash flow health—all crucial for sustained business growth.

By helping you understand the true “cost” of money in terms of life energy, it prepares you to tackle budgeting from an informed and strategic angle, considerations that are critical in early-stage ventures navigating complex financial landscapes.

–John F. Pace, CPA, Tax Partner, Pace CPA

Check out this best tool for writing content 10x faster

I Will Teach You to Be Rich by Ramit Sethi

This book may have a more aggressive approach compared to others, but it offers practical strategies for automating finances, negotiating bills, and increasing income.

While it targets a younger audience, its advice can be applied to anyone looking to improve their financial life.

Ramit Sethi, the author, has also created a community and online course based on the book, providing additional support for those following his strategies.

The One Week Budget by Tiffany Aliche

A good budgeting book for the average consumer is hard to find.

Sometimes there is uncommon jargon, and steps or tips that simply don’t work for the average person.

This is why I feel that “The One Week Budget” by Tiffany Aliche stands out as a must-read book, due to its practical and actionable approach to personal finance.

It’s a practical guide that anyone can use and is one of the best personal finance books out there.

Aliche, also known as “The Budgetnista,” offers readers a clear and structured framework for managing their finances effectively, even within a short timeframe.

The book outlines step-by-step instructions for creating a budget, reducing debt, saving money, and building wealth, making it accessible to individuals at any stage of their financial journey.

One of the book’s strengths lies in its emphasis on simplicity and flexibility.

Aliche recognizes that not everyone has the same financial situation or goals, so she provides strategies that can be tailored to fit individual circumstances.

Whether readers are struggling to get out of debt, save for a major purchase, or plan for retirement, “The One Week Budget” offers practical advice and real-life examples to inspire and motivate them to take control of their finances.

By empowering readers with the knowledge and tools they need to achieve financial stability and success, this book has the potential to transform lives and help individuals build a brighter financial future.

–Melissa Cid, Consumer Savings Expert, MySavings.com

The Financial Diet By Chelsea Fagan

In my opinion, Chelsea Fagan’s “The Financial Diet” is one of the best budgeting books for people who aren’t usually interested in personal finance.

It’s an ideal read for graduates or beginners who are looking to start on the right financial footing to create the life you want.

‘The Financial Diet’ goes beyond just budgeting; it also covers other important financial topics like career advancement, investing, food, and home management.

You’ll learn practical steps for creating a budget. It’s perfect for young adults eager to enhance their financial literacy and habits, individuals who struggle with managing their finances, or honestly, just about anyone interested in learning practical tips for achieving financial stability.

Overall, it’s a comprehensive beginner’s book that’s great for those who don’t know where to start with budgeting.

–Amir Elaguizy, CEO and Co-Founder, Cratejoy, Inc

The Total Money Makeover: A Proven Plan for Financial Fitness By Dave Ramsey

Who doesn’t know Dave Ramsey?

One of the best books on budgeting that I highly recommend is “The Total Money Makeover” by Dave Ramsey. It’s a New York Times bestseller.

This book offers a straightforward, no-nonsense look at personal finance and budgeting, making it accessible to readers at all levels of financial literacy.

Dave Ramsey’s method is rooted in practical, actionable advice that helps individuals take control of their finances, eliminate debt, and build wealth.

What sets this book apart is its clear and relatable step-by-step plan, known as the “Baby Steps.”

These steps guide readers through the process of saving for emergencies, paying off all debts except the house, saving for retirement, and ultimately achieving financial freedom.

Ramsey’s use of real-life success stories throughout the book inspires and demonstrates that his principles can work for anyone committed to following them.

There are everyday money-saving habits with relatable anecdotes that can anyone can follow.

I recommend “The Total Money Makeover” because it emphasizes the importance of living within your means, creating a realistic budget, and making financial decisions that align with long-term goals.

Whether you’re struggling with debt or simply looking to improve your financial health, this great book offers a comprehensive blueprint for transforming your financial situation and achieving lasting financial success to live rich.

–Richard Dalder, Business Development Manager, Tradervue

The Simple Path to Wealth By J.L. Collins

“The Simple Path to Wealth” breaks down the seemingly complex secrets of wealth creation into simple guidelines.

This book provides valuable advice on budgeting, investing, saving, and building wealth and net worth for the long term.

The focus is mainly on simplicity and passive investing.

Collins shares the fundamental financial wisdom you need to make your money work for you, not against you.

This book taught me the importance of learning the basics of personal finance, which helped me avoid the complex and enticing investments that often lead to losses.

I started to focus on simple strategy wins that helped me avoid debt and spend less than I earned.

Instead of worrying about things I cannot predict or about people who don’t add value to my life, I focus on the precious few things in my control.

I recommend the book to anyone wanting to get their personal finances in order.

The principles of this book are relevant today and will give you the secrets of the good life.

–Vladislav Podolyako, Founder and CEO, Folderly

The Millionaire Next Door: The Surprising Secrets of America’s Wealthy by Thomas J. Stanley and William D. Danko

This is one of the best books on budgeting.

This classic book challenges common misconceptions about wealth and explores the habits of millionaires in America.

It highlights the concept of living below your means as a key factor in building wealth and avoiding lifestyle inflation.

It offers simple rules for spending habits, saving, and a proven system for becoming a millionaire, and even how to retire early.

Broke Millennial By Erin Lowry

“Broke Millennial” by Erin Lowry won’t make you an automatic millionaire, but it will show you how to take control of your finances, plan your spending and savings, and stop drowning in debt.

As the book addresses the financial challenges faced by millennials (and maybe Gen Z a bit), it takes into account current financial challenges and economic realities, showing how to develop your personalized path to effective budgeting, navigating through student loans, low starting salaries, small investments, and even taking advantage of the gig economy.

This book discusses what decision a broke millennial takes and gives you simple steps to stop scraping.

The book offers more than prose and a humorous narrative.

It includes actionable steps and clear guidance, allowing readers to implement the advice in real life.

All tips, supported by step-by-step instructions, make applying the concepts to one’s financial situation easy. Budgeting templates, financial checklists, and recommended tools and apps are there to provide additional support.

The core of the book is self-empowerment, which conveys an eye-opening message – nothing will be done for you; you are responsible for finances and your approach to money management.

–Nina Paczka, Community Manager, MyPerfectResume

The Psychology of Money: Timeless Lessons on Wealth, Greed and Happiness by Morgan Housel

This is also one of the best books on budgeting in my opinion.

It teaches you how to think about money more practically, rather than just focusing on the numbers.

It also covers topics such as risk-taking, financial history, and understanding your own relationship with money.

I like that this book includes real-life stories and examples to illustrate its points, making it an engaging read for those looking to improve their financial mindset.

Talking about budgeting, make sure to keep track of your finances using this tool.

The Richest Man in Babylon By George Clason

When I decided it was time to get my finances in order, I read “The Richest Man in Babylon” by George Clason, and I regard it as the best budgeting book to this day.

To start with, its lessons are laid out in a story form based on ancient Babylon. This technique makes the book easily digestible, especially for people who may not be too keen on going through numbers or are not avid readers.

The book proposes a 70-20-10 budgeting structure: 70% of income is spent on everyday expenses such as food, entertainment, and clothing, and 20% goes towards debt repayment.

The book caters mainly to people with bad debt, but in my opinion, this approach is a healthy one even for paying student, car, and mortgage loans. The 10% goes to savings.

Compared to many budgeting books, “The Richest Man in Babylon” is practical and considers the fact that you still have to live even as you seek to budget your income and get the most out of it.

The book is short and can be easily read within a week at a good pace of just 10 pages a day.

–Clooney Wang, CEO, TrackingMore

Small Business Cash Flow By Denise O’Berry

I recommend “Small Business Cash Flow: Strategies for Making Your Business a Financial Success” by Denise O’Berry.

It focuses on managing cash flow, an essential aspect of budgeting for small businesses.

It helped me create a monthly budget planner and save for unexpected expenses.

–Heather Eason, Founder, President & CEO, SELECT Power Systems

Here’s a free trial for your small business financial reporting

The Wealthy Barber By David Chilton

I recommend “The Wealthy Barber” by Canadian author David Chilton.

It is one of the best books on budgeting.

This book offers practical, down-to-earth advice on managing personal and business finances.

Here are three key ideas and how I applied them to my business:

Pay yourself first. Chilton emphasizes setting aside a portion of income for savings before paying any other expenses.

I used this advice and created a business emergency fund; a percentage of our profits goes into savings to handle unforeseen expenses.

Live within your means. The book advocates for prudent spending and avoiding unnecessary debt.

I implemented this by carefully monitoring our business expenses and avoiding high-interest loans, focusing instead on sustainable growth.

Invest wisely. Chilton advises on making informed investment choices. I invested in a high-ROI marketing channel – local SEO. It increased the customer base and offered the best ROI.

“The Wealthy Barber” provides timeless wisdom that any entrepreneur can apply for long-term success and early retirement.

–David Owen, Founder, Dozy

Financial Literacy for Young Adults Simplified by Raman Keane

This is a great budgeting book because you learn how to manage, save, and invest money to build your future.

The best part is that you can get started as a young adult and avoid common financial mistakes that can hinder your progress later in life.

What I liked about this book is that it’s concise and easy to understand, making it accessible to readers of all ages.

The Automatic Millionaire by David Bach

This book is an easy read based on timeless principles and secrets you can use to become a millionaire.

I like that this book provides actionable steps for setting up automated systems to save and invest money, making the process of building wealth more manageable and less daunting.

Additional Books Related to Budgeting

Check out these additional books on business, finance, budgeting, taxes and more

- 13 Best Books Female Entrepreneurs Must Read

- 15 Best Books on Blogging to Make Six-Figures

- 18 best Books on Taxes

- 23 best copywriting books of all time

- 15 best books for aspiring writers

- 17 Lessons in Business Shared by Top Entrepreneurs

- CEO bookshelf: 30 best books for business

Tips for Choosing the Right Book on Budgeting

When searching for the right book on budgeting, it’s essential to consider your individual financial goals.

Each book may have a different focus or approach that may align better with your specific needs.

Additionally, here are some tips to keep in mind:

- Read reviews and see what other readers have found helpful in each book

- Look for updated editions or newer publications for more relevant information

- Consider seeking recommendations from trusted sources such as financial advisors or friends who have successfully managed their finances through budgeting methods.

3 Best Budgeting Book Planners

While there are many great books on budgeting, you should also check out these budgeting book planners below

- Budget planner: 12 month undated budget planner organizer to crush your financial goals

- Budget planner workbook: Manage your finances and plan your expenses for the year

- Budget planner: the ultimate tool for wealth management and cash flow

These planners offer pre-designed templates for tracking income, expenses, and savings goals, along with tips and advice for creating a personalized budget plan.

They also provide space for reflection and goal-setting to help readers stay accountable on their financial journey.

Talking about planners, check out these best planners for bloggers here.

SUBSCRIBE TO MY YOUTUBE CHANNEL HERE TO LEARN MORE

Final Thoughts – Best Budgeting Books

Budgeting is a crucial aspect of personal finance that can lead to long-term financial stability and success.

Instead of hiring a financial advisor, these books on budgeting offer in-depth knowledge, diverse perspectives, and practical strategies for achieving financial goals.

By investing in a book on budgeting, you can gain valuable insights and take control of your finances.

Save this helpful list of top books on budgeting and tips for choosing the right one for your needs.

Let me know in the comments which one is your best budgeting book.

RELATED BLOG POSTS TO BOOKS ON BUDGETING

Be sure to check out my legal tips page. It has my best legal and business tips that help you protect yourself and your business.

You’ll find many resources and my best blog posts on legal topics.

Here are some other helpful posts:

- What Is a Media Release Agreement and How to Use It?

- How to Optimize Images for WordPress the Right Way

- Affiliate Agreement: Why Do You Need It for Your Affiliate Program?

- 5 Steps to Easily Manage Your Finances as a Digital Entrepreneur

- Coaching Agreement and Contracts You Need for Your Coaching Business

- 16 DIY Legal Document Templates for All Entrepreneurs

- 11 Best Books for Female Entrepreneurs You Need to Read Today

- 7 Things to Do Before You Can Quit Your 9-5

VISIT THIS FREEBIES PAGE TO GET 5 AWESOME FREE BUSINESS, BLOGGING AND LEGAL TIPS!

Below are some more helpful blog posts, legal tips, tools, and resources that you should check out next:

- Outrank your competition and enhance your content creation

- Beautiful Pinterest templates to increase traffic to your blog!

- What’s an LLC and when to form one?

- How to Legally Protect Your Book (with Proper Copyright Notice and Disclaimer Examples)

- AI writing tool to write blog posts 10x faster, create social media content, videos, and any kind of content to save time in business

- This SEO tool makes sure your blog posts rank on the first page of Google!

- Manage your accounting effortlessly with this amazing tool.

MORE TOOLS TO GROW YOUR ONLINE BUSINESS

- TubeBuddy to grow your YouTube channel, and this is another great tool for YouTube SEO.

- Free SEO Masterclass to learn how to optimize your blog posts for SEO to rank on Google.

- You can also buy this awesome bundle of ebooks instead if you prefer ebooks over video training.

- Best accounting software to manage profit and loss and more!

- Best payroll service(super affordable, too)

- A great all-in-one business platform for hosting your course, email communications, sales pages, and more!

- This paraphrasing tool to create original work for the client

- A professional theme for your website

- Millionaire blogger’s secrets here and tons of valuable resources.

- How to start your blogging business and make money online

- How to make money from affiliate marketing

- The Best Freelance Writing Contract Template (for writers and clients)

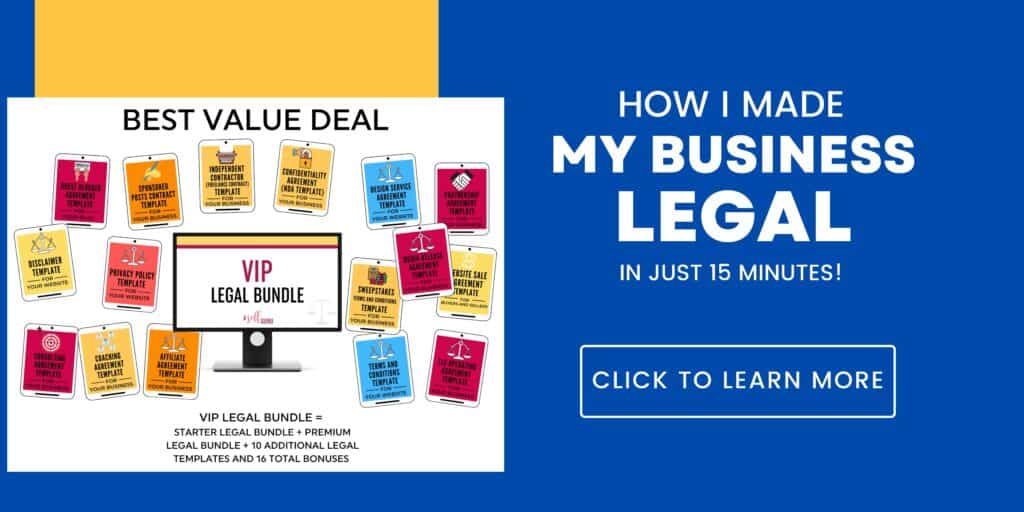

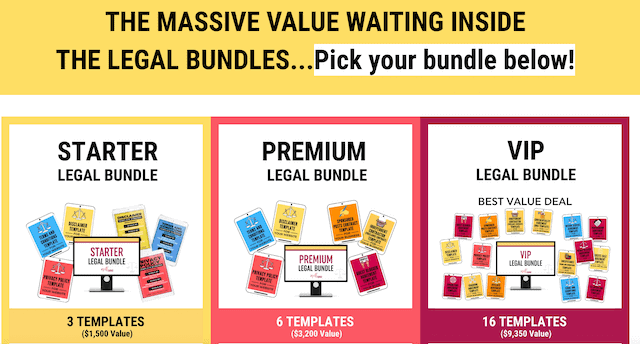

- Guest Blogger Agreement to publish guest posts on your website legally and avoid any copyright infringement, Media release agreement to be able to use other people’s photos, videos, audio, and any other content legally, Privacy policy on your website to ensure your blog’s legal compliance, Disclaimer to limit your legal liability, Terms and Conditions to set your blog rules and regulations! Get all of these templates at a discounted rate in one of my best-selling VIP legal bundle here.